There's a 20K Chase Freedom Signup Bonus Offer, which I've added to the Best Travel Credit Cards page. The usual signup bonus is just 10,000 points (or $100), so if you were planning to get this card anyway, it's a good time.

Here are the details, as well as the pros and cons of this card.

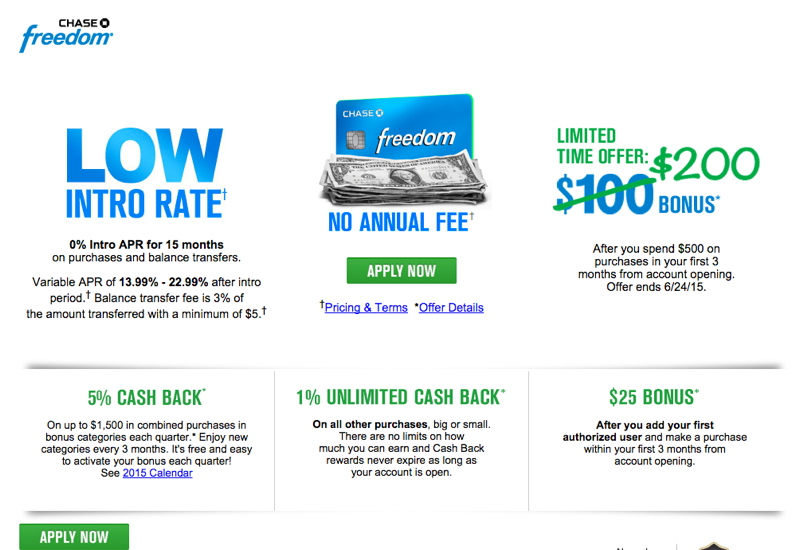

- Earn 20,000 points after you spend $500 on purchases in the first 3 months from account opening

- Earn 5% cash back on up to $1500 in combined purchases each quarter

- Earn 1% cash back on all other spend

- No annual fee

- Offer ends 6/24/15

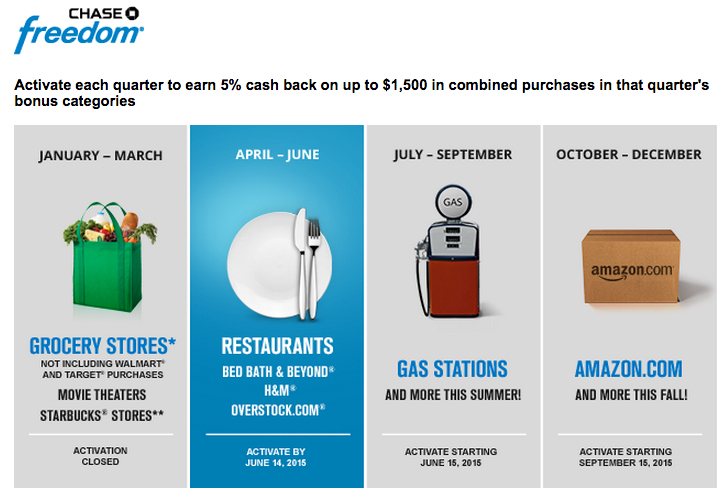

Q2 2015 5X Categories

If you get the Chase Freedom now or already have the card, you have until the end of June 2015 to enjoy 5X on all restaurants. No need to dine out only in June either–I recommend you stock up on gift certificates to your favorite restaurants, which you can enjoy later this year or next year while still maxing out the 5X bonus of $1500 per quarter.

The 5X also applies to Bed, Bath & Beyond, Overstock and H&M, but since we don't normally buy anything at these stores, for us it's all about the 5X on restaurants.

Returning to the 20K Chase Freedom bonus–should you apply for the Chase Freedom card if you don't already have it? I've held my Chase Freedom longer than most of my other credit cards, thanks to the no annual fee, but it's also true that I don't use it nearly as often on a regular basis as I used to, before Chase eliminated the Old Chase Exclusives for the Chase Freedom Card, Even for Grandfathered Members.

Here's what I view as the pros and cons of the card:

Pros

- No Annual Fee: No need to ever cancel this card, since there's no annual fee to pay. That helps your credit score over the long run, by increasing your average age of accounts. See Understand How Your Credit Score Works to Maximize Credit Card Rewards

- 5X for Dining, Grocery Stores: My favorite Chase Freedom 5X categories are 5X for restaurants, which is this quarter, Q2 2015, and 5X for grocery stores, which was Q1 2015. But you may have different favorites. In general I don't find the 5X Starbucks or on various retailers that compelling, since it's often possible to simply buy gift cards at Staples with my Ink Plus to get the same benefit. And gas stations isn't compelling for us, living in Manhattan without a car, but could be useful if you have high gas spend.

- Transfer to Frequent Flyer Miles: While the con (see below) is that you need a Chase card linked to Ultimate Rewards such as the Sapphire Preferred or Ink Plus, which carry annual fees, if you have either one, you can transfer out to several frequent flyer and hotel loyalty programs. I especially like that Singapore KrisFlyer is a Chase Ultimate Rewards Transfer Partner and I also like to transfer to Korean Skypass.

- Chase Ultimate Rewards Mall: These days Ultimate Rewards Mall bonuses are often the same for all Chase cards, but you may want to double check the Chase Freedom version of the Ultimate Rewards Mall in case the merchant offers a higher bonus than is available when clicking through from your Ink Plus or Sapphire Preferred Account.

Cons

- Low signup bonus: This is of course true of most no annual fee cards. Still, the current 20,000 signup bonus is better than the usual 10,000 signup bonus.

- Must have a Ultimate Rewards linked annual fee card to transfer points out: You'll need a Sapphire Preferred, Ink Bold (if you already have one–note that no new applications are possible since the Ink Bold has been eliminated–see Bye Bye Ink Bold) or Ink Plus in order to transfer points earned with your Chase Freedom to Ultimate Rewards airline and hotel partners, such as Singapore KrisFlyer, Korean Skypass, United MileagePlus, Hyatt Gold Passport, etc.

- 5X categories have gotten less lucrative. I no longer max out my 5X categories for some quarters, particularly when the 5X categories are gas stations and Kohl's or department stores. Generally speaking, unless there's a great Ultimate Rewards Mall bonus for a given store, Amazon has lower prices so I do better with 5X on all Amazon spend.

- Have to activate your 5X each quarter: Chase is trying to encourage “engagement” with their card product, but I hate having to do this. The bonus should be automatic, as it is with virtually every other card's category bonus.

- Old Chase Exclusives Program Ended, Current One Not As Lucrative and ends after this year: See Goodbye Old Chase Exclusives for Freedom Card Even for Grandfathered Members. Chase will also be discontinuing the 10% points dividend after 2015, with the last bonus points distribution in February 2016.

Do you have or plan to get the Chase Freedom card?

Related Posts

5X for Restaurants and Dining with Chase Freedom Q2 2015 Bonus

Travel Credit Cards: What's in My Wallet Now

How to Combine Ultimate Rewards Points on New Chase Web Site

Best Credit Cards by Spend Category

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 200,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book Your Hotel with Virtuoso or Four Seasons Preferred VIP Amenities!