I get several emails a day from readers along the lines of “hey, I’m new to the points game, where do I get started?” Given that I often write about mileage runs (flying for the purpose of accumulating airline miles), people seem to assume that’s the best place to get started. In the past that was true, with low fares, plenty of promotions, and not-so-great credit card sign-up bonuses.

The game has really changed over the past couple of years, though. Rewards for flying have gone down in the form of higher fares and fewer promotions, while rewards for signing up for credit cards have gone up massively, in the form of 75,000-100,000 point sign-up bonuses.

So nowadays the simple answer is “if your credit score can handle it, sign up for credit cards as much as you can.” The activity many of us participate in is known as “credit card churning,” which is signing up for credit cards just for the bonuses associated with activating and completing a minimal amount of spend on a card. One can easily earn half a million points a year just by signing up for credit cards, and literally pay only a couple of hundred dollars at most in annual fees. There’s no mileage run in the world that will give you that many points or miles in return for that small of an investment.

When I suggest this to people not familiar with the concept, the response is almost always “there’s no way that’s possible. Doesn’t that ruin your credit score?” Well, amazingly enough, no.

So let’s go through the basics. Up front I should say that I’m no expert on the subject, but instead am sharing my personal experiences and what I’ve learned from others, having earned well over a million miles and points by signing up for credit cards.

Who Should Not Sign up for Credit Card Rewards

So let’s start by talking about who should not be signing up for credit cards for the points. First of all, if you usually carry a balance on your credit cards, you shouldn’t sign up for a points earning credit card. These cards usually have incredibly expensive financing options, which will quickly negate any points you may have earned. Along the same lines, if you live beyond your means, these cards aren’t for you, as they often come with high credit lines and “pay over time” options, where you’ll end up paying double or triple the amount of the purchase over a period of a few years.

Next, you should have a steady income. If not you’ll have a hard time getting approved for credit cards.

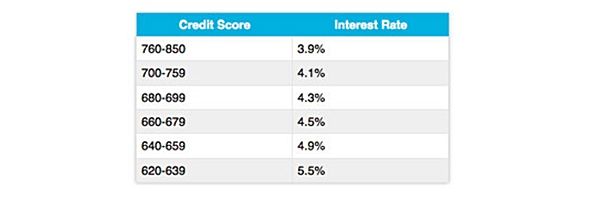

Lastly, you probably shouldn’t sign up for credit cards if you’re planning on financing a house, car, etc., anytime soon. Your credit score takes a temporary hit of a couple points for every card you apply for, and if you’re getting a mortgage on a house, the difference between a “good” credit score and “excellent” credit score could save you thousands of dollars over the course of paying your mortgage.

Your FICO Credit Score and What it Means

Now let’s talk about your FICO credit score and what it means. Scores via Experian's FICO Score 8 range from 250 to 900, and generally a score of over 780 is considered good. If you’re going to credit card churn you probably want to be closer to 800, which will get you consistent approvals.

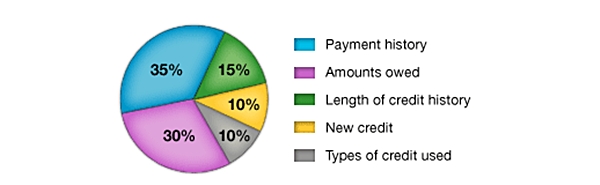

In order to be able to improve your credit score it’s important to understand what comprises it. There are five main areas that are factored in when determining your credit score. As you can see from the FICO Chart below, almost two-thirds of your credit score is determined by your payment history and amount that you owe, so let’s tackle those first, followed by length of credit history, new credit, and types of credit used.

35% of your credit score is your payment history. It takes into account:

- Any negative public financial records, such as bankruptcy, lawsuit judgments, wage garnishment, etc.

- How long your accounts (if any) are past due

- Amounts that are past due

- How recent the negative public records or delinquent accounts are (e.g. a delinquent account many years ago won’t hurt you as much as one delinquent last year)

- The number of past due accounts, and the number of accounts paid on time

Tips:

- If for some reason you can’t pay everything off, focus on paying off in full the amounts that have been past due the longest

- If you do ever get a call from a collections agency, respond and resolve the item as soon as possible and make sure to negotiate a removal of the collection from your credit file on condition that you pay the amount in full

30% of your credit score is your credit utilization and outstanding debt. If you’re constantly maxing out the credit limits of your cards or have a dozen mortgages it will raise a red flag. Therefore you should try and keep your credit utilization low whenever possible, ideally below 40-50%. That means if you have a credit card with a $10,000 credit limit, try not to spend more than $4000-5,000 on it per month. If you do need to put more on it for a given month, pay it off immediately, between statements, so that your utilization remains low. The good news is that once you have significant credit limits with several cards open, you should be able to keep utilization low on each of them.

Tip:

- If you only have a few credit cards, which you use heavily, consider asking for a credit limit increase, which will lower your utilization so you don’t have to keep paying off the balance so often between statements. If you apply for more cards from the same bank, you can then ask to have some of the credit limit shifted to the new card(s) if needed.

15% of your credit score is your credit history. Obviously you’re more trustworthy if you’ve had a good history for 30 years, as opposed to three months. This is one reason it makes sense to keep some cards for a long time and never close them, because they will demonstrate your reliability over time. This is the reason I keep two no annual fee credit cards in my drawer, which increases the average age of my accounts. Do note that even when you close a credit card, it typically isn't removed from your credit history immediately; it could even stay on your report for 10 years, and as long as it was in good standing (paid up) when it was closed, it could help your average age of accounts as long as it's there. But once it does fall off all of that history is gone.

Tip:

- You may plan to close a credit card which you received a bonus for and got the annual fee waived in the first year when it’s renewal time. Instead, ask to speak with the retention department to see if you can either get the annual fee waived for the second year, or if you can be “downgraded” to a no annual fee card. That way you get the benefit of an older account.

10% of your credit score is from your new credit requests. This is the part of your score that would be impacted by signing up for a new credit card. To the credit card companies signing up for new credit cards or taking on new mortgages shows a possible need for money. This is why your credit score goes down a few points every time you apply for a card, and although the impact can last a year or so, in many cases it disappears after the first 90 days. In moderation applying for new credit cards is fine, though it’s rather suspicious to the banks when you apply for ten new credit cards within a month. While my intention may only be to earn miles, it certainly looks to the banks like I’m short on money and may not be able to pay my bills.

Tips:

- Avoid opening a bank account with overdraft protection, as it almost always results in a hard pull, lowering your FICO score. Sometimes opening even a regular bank account results in a hard pull, so be leery of opening too many bank accounts if you also want to apply for multiple credit cards

- If you’re applying for a mortgage, note that multiple inquiries within a 45 day period counts as one hard pull, so don’t worry about shopping around for the best rate.

10% of your credit score is from the types of credit used. This refers to whether you primarily have revolving accounts, such as credit cards, or installment loans, such as mortgages. The more variety you have, the better, since it shows you’re trustworthy. Ironically, this is part of the reason why even people who have never been late with a credit card payment, own their own car and rent can still end up not having as stellar a credit score as someone who is heavily indebted with a mortgage and car payments—that diversity of credit helps, as long as payments are being made on time. Per Experian.com: The presence of a real-estate loan that always has been paid on time shows lenders that you have established a strong credit base and reflects positively on your credit responsibility. The lack of a real-estate loan on your credit report does not decrease credit scores. However, it generally means that credit scores are not as high as they could be.

Tips:

- Naturally, don’t jump into a mortgage just to get a better credit score.

- If, however, you are seriously considering a mortgage within the next year, get your credit score as high as you can so that you can benefit from a lower interest rate. Look at the chart below from a few years back, to see how your credit score can affect your mortgage interest rate (estimates are for 30-year fixed rate mortgage)

How to Spread Out Your Inquiries Among the Reporting Agencies

When you apply for a credit card there are three credit bureaus — Equifax, Transunion, and Experian — that report to FICO to determine your overall score.

As a result it makes sense to spread out inquiries with each reporting agencies when applying for credit cards. In other words, say I want to apply for three credit cards today. It would be ideal if I could get one card that pulls credit from Equifax, one from Transunion, and one from Experian.

To determine which credit bureau a particular card will pull from, check out the Credit Pulls Database at creditboards.com. Just enter your state and pick a credit bureau, and you can see reports from others as to which agency a certain card pulled from.

For example, using Florida as the state, I see that someone reported the American Express Delta SkyMiles Gold Card as being pulled from Experian, and the US Airways BarclayCard as being pulled from Transunion. The database is also useful because it lists whether or not people were approved based on their credit scores, and also what type of credit lines they were given. This can be a good indicator as to whether or not you’ll be approved for the card given your individual situation.

How to Get Your Credit Scores and Reports

All of the above is only useful once you have your credit score and report, though. Let’s clarify that there are actually 4 scores: your actual FICO score, and then the scores and reports of each of the three credit card reporting bureaus mentioned above—Equifax, Transunion and Experian, and each of them may have slightly different information on you. There are several places that offer a free trial of the 3 credit scores from Equifax, Transunion and Experian; a quick Google search turned up IdentityIQ, though I should say that I haven’t used and can’t vouch for them. Some of the others that are free, such as

creditkarma.com, just provide one bureau’s score, so it would probably be better to get one that has all three. In all cases, it’s worth noting that they’re all quite a pain to use. You get a free trial and have to give credit card information, as they auto-renew. You need to then call their (usually outsourced) customer service to cancel your free trial within a few days, and then you won’t be billed. It’s well worth the effort, though don’t expect it to only take a couple of minutes.

For a free FICO score, you could try myFICO—again, I haven’t personally used it, and you will need to make sure you cancel within 10 days to avoid paying them a monthly fee.

How Many Credit Cards Can I Apply For?

Once you know your credit score and which credit bureaus specific cards pull from, you’re probably wondering how many cards you can apply for. The easy answer is “as many as you want, as long as they keep approving you.” The major limit is the number of cards you can get with any single bank or company.

Chase, for example, has a 5/24 rule whereby you typically won't be approved for a new Chase credit card if you've already had 5 credit pulls (from any issuer, not just Chase) over the past 24 months.

American Express often has “once in a lifetime” language that prevents you from earning a new credit card bonus if you currently have or have previously had that exact credit card product.

How Long Should I Keep Credit Cards For?

Once you’ve been approved for a new card, the first logical question is probably “how long do I keep it for?” Many cards come with no annual fee for the first year, while others have an annual fee which is well worth it given the sign-up bonus. Assuming you don’t plan on keeping the card long term, I generally suggest keeping the card open for as close to a year as possible. As mentioned above, longevity of accounts factors into your credit score, so having an account for 11 months is better than having an account for only a few months.

Furthermore, some banks, like Chase, threaten to take away your rewards if you cancel within six months of opening your card. I don’t often hear of them enforcing that policy, though there’s no good reason to risk it.

One other idea would be to threaten to cancel somewhere between six and 11 months of getting the card. This is because credit card companies will often offer “retention bonuses” for you to keep the card, typically in the form of a statement credit or some bonus points or promotions. So it can’t hurt to call in and say you’re at least considering canceling the card, and see if they throw anything your way.

Hopefully that covers the basics. If anything above isn’t clear or you have any questions, feel free to leave a comment and I’ll do my best to help.

Related posts

Best Travel Credit Cards for Signup Bonuses and Everyday Spend

If you enjoyed this, join 200,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book Your Hotel with Virtuoso or Four Seasons Preferred VIP Amenities!

Photo credits: TheTruthAbout, MyFICO

Editorial Disclosure: The editorial content on this site is not provided by the companies whose products are featured. Any opinions, analyses, reviews or evaluations provided here are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by the Advertiser.