11/13/14 Update: The Ink Bold is Gone–RIP.

———-

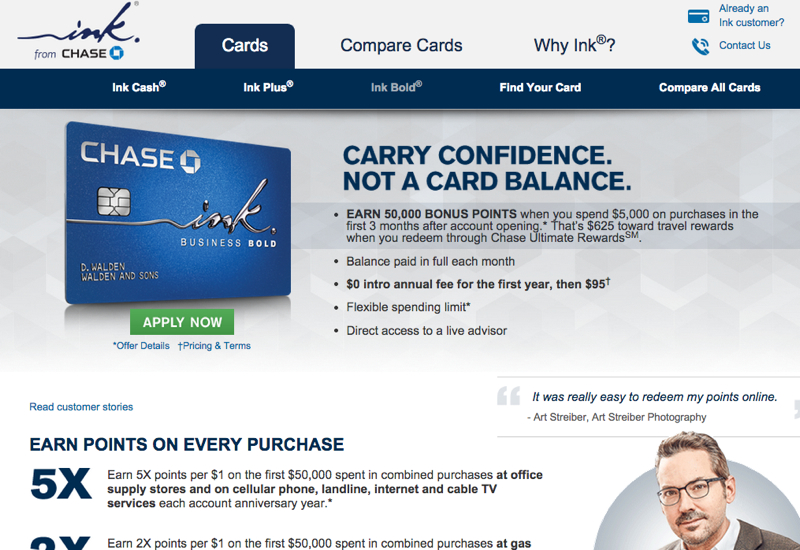

Bye Bye Ink Bold: the Ink Bold small business card from Chase is going away, per Dan. While most of the focus on Ink cards the last few months has been on the 70K Ink Plus offer, which you can now earn bonus points by referring a friend to (see 70K Ink Plus Bonus Refer a Friend Offer: Up to 50K Points for Referring Friends) it's always sad to see good miles and points earning cards go away, unless they're replaced by another better card.

That's because you can typically only earn a signup bonus on Chase credit cards and charge cards once, so fewer cards means fewer signup bonuses. AMEX signup bonuses have also become once in a lifetime, and while Barclays cards can be churned, Barclays is very strict and often declines churners. Its US Airways MasterCard is going away later this year, as part of the American – US Airways merger, so that's a good card to include with an Ink Bold or Ink Plus application, if you haven't recently gotten it.

So, if you've never had an Ink Bold card, or even if you've only had the MasterCard version, you may want to consider applying for the Ink Bold Visa (all Chase cards including the Ink business cards are now issued in Visa versions only). If approved and you meet the minimum spend, you'll earn 50,000 Ultimate Rewards points.

FAQ

What's the Difference Between the Ink Bold and Ink Plus?

The Ink Bold is a charge card, that you must pay off in full every month (which you should do anyway with all your credit cards–if you carry credit card debt, the high interest charges will negate the value of the miles and points you earn). The Ink Plus is a credit card.

Which Is Better, the Ink Bold 50K Offer with No Annual Fee the First Year or the Ink Plus 70K Offer with $95 Annual Fee?

The 70K Ink Plus is a better offer, even with the annual fee, but the reason to get the Ink Bold 50K offer is that it won't be around much longer. If you have strong credit and two businesses, you may be able to get both offers.

Can I Apply for the Ink Bold in a Chase Branch?

No–it's no longer possible to apply for an Ink Bold in a Chase Branch. Affiliate links have also been pulled, so the only way to apply is directly through the Chase Web site: (Update: link removed since Ink Bold is gone and it can't be applied for online either)

Can I Apply Even If I'm Not Incorporated and Don't Have an LLC?

Yes–just use your social security number instead of an EIN for your business.

Am I Eligible for the Ink Bold Visa If I Recently Had the Ink Bold MasterCard?

The offer terms state “This new cardmember bonus offer is not available to either (i) current cardmembers of this business credit card, or (ii) previous cardmembers of this business credit card who received a new cardmember bonus for this business credit card within the last 24 months.”

This language would seem to indicate that you're not eligible if you've had the Ink Bold within the past 24 months, but historically Chase has viewed the MasterCard and Visa versions of a card as different products, so I do believe you have a good chance of earning the signup bonus if you have *not* had the Ink Bold Visa within the past 24 months, but have had the Ink Bold MasterCard. But I'm not Chase, so I can't guarantee you'll receive the bonus–you'll have decide whether a hard pull is worth it or not for you, given the potential risk of not receiving the bonus.

Do you plan to apply for the 50K Ink Bold bonus offer before it goes away?

Related Posts

70K Ink Plus Bonus Refer a Friend Offer: Up to 50K Points for Referring Friends

Harder to Get Approved for Chase Ink Bold and Ink Plus?

5X Points for Whole Foods Groceries via Staples and Ink Cards

Best Ways to Use Chase Ultimate Rewards Points

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 150,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book Your Hotel with Virtuoso or Four Seasons Preferred VIP Amenities!