A TravelSort reader asks: “How many credit inquiries is too many when you're looking to apply for more credit cards? In other words, at what point do you say–I've X amount of credit inquiries, and I should wait before applying for more credit?”

Great question, and relevant for anyone looking to open more than just a few credit cards in order to earn miles and points for travel.

The problem, however, is that credit inquiries or hard pulls, just as with the other aspects determining your credit score, are just one aspect. So for example, someone with high income and a 20 year stellar credit history, with most cards held for 10 years or more, on-time payments and no delinquincies, and low utilization of credit lines who starts applying for cards might be able to get approved with 15 or more inquiries total on his her credit report, whereas the story will be quite different for, say, a college student with low income and short credit history.

A few pointers, in the form of a FAQ:

For Credit Inquiries, What's a Hard Pull vs. a Soft Pull?

When you apply for a new credit card, mortgage, or other loan, that results in at least one hard pull. This is noted on your credit report and lowers your credit score by a few points for about six months, although sometimes you'll recover the points within 90 days or so.

If you check your own credit report, a potential employer conducts a background check that includes a credit check, or a credit card company prescreens you for an offer, that results in a soft pull. A soft pull does not affect your credit score.

How Many Hard Pulls Is Too Many?

As I mentioned in the intro, there's no one size fits all answer here, since each person's income and credit history is different. It's also important to look not just at the total number of inquiries, but rather the number of inquiries for each credit reporting agency: Experian, Equifax and Transunion.

I'd say that for many folks, there's cause for concern if you have 10 or more inquiries for a single credit reporting agency for a 1 year period, especially in the most recent year. All else equal, 10 inquiries this past year and none the year prior is worse than 10 inquiries 1 year ago, and none in the past year. Of course, it may be that given a person's income and credit history, even 4 inquiries in the past year from a single credit bureau would be too many for an issuer.

How Many Credit Pulls Does a Bank Normally Do When I Apply for a New Credit Card?

Typically one, although sometimes two:

- If your application is initially pending, and you later call up reconsideration to get approved, there may be another hard credit pull done during reconsideration

- If you've frozen the credit bureau the bank usually pulls from (more on that later) then the bank may pull from the two other credit reporting agencies, rather than just one of them

So Which Factors Are More Important Than the Number of Inquiries for My Credit Score and Credit Card Approvals?

- Income: It stands to reason that banks (or anyone extending credit) wants to know how they're going to get repaid. A high and steady income helps considerably.

- Payment History: The most important factor in your FICO score is payment history, including whether you pay on time, any past due accounts or bankruptcies, etc.

- Credit Utilization: This is just behind payment history in importance to your credit score, but people often don't realize it. You want to have high credit lines, but low utilization. For example, if you have a $20,000 credit line on a credit card, don't just put $15,000 in house remodeling expenses on it and leave it until the statement comes due–pay it off as soon as it hits as an actual charge. The only exception is business credit cards, which don't report to the credit rating agencies–that's why savvy card churners tend to put all the expenses they can on their business cards, making it easy to keep utilization on personal credit cards very low.

- Average Age of Accounts: This is the reason you should never close your oldest credit cards, and should make those oldest cards no annual fee credit cards.

Also see our discussion of these factors in Understand How Your Credit Score Works to Maximize Credit Card Rewards

How Do I Figure Out Which Credit Bureau A Bank Uses?

You can figure this out a few ways:

- Your Own Credit Report: You can get a free copy of your credit report from all three credit reporting agencies via AnnualCreditReport.com, and since this has your hard and soft credit pulls for the past 2 years, you'll be able to see the credit bureau that each bank used for credit cards you've recently applied for. And if you're ever denied a credit card and can't get it approved even by calling reconsideration, make sure you request a free copy of your credit report. Note that you must make the request within 60 days of receiving your denial notice.

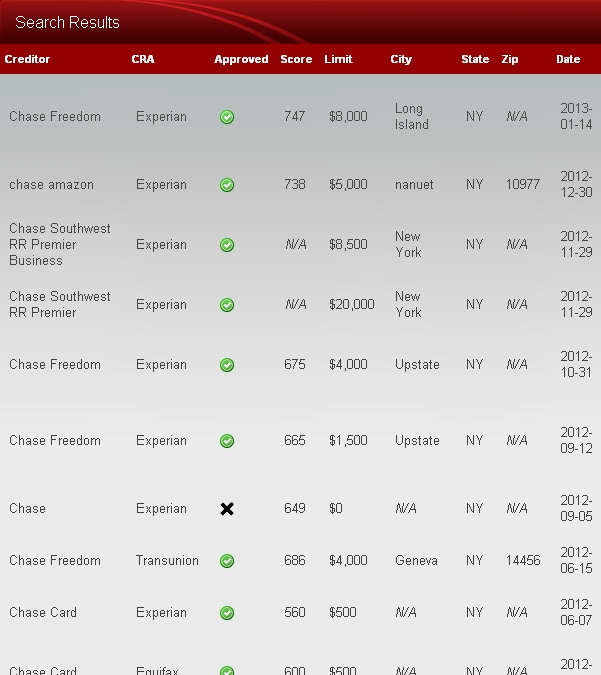

- The Credit Pulls Database: If you don't have a copy of your credit report handy or haven't recently applied for credit cards, this is a good way to search by issuer or creditor (e.g. bank) and your state to see what Chase, AMEX, Citi etc. normally pull from in your area. For example, if I type “Chase” into the “Creditor” field and select New York from the dropdown as the state, I can see that in New York, Chase pulls Experian, and in the comments section (cut off in the screenshot) it's clear that those applicants who had Chase pull Equifax or Transunion had that happen at their own request, usually because they froze Experian. Note though that with large states such as California, a bank or creditor may use a different credit bureau for different cities–so pay attention to the city, if provided in the search results.

- FlyerTalk Credit Pulls Database: This isn't as easy to use as the above Credit Boards Credit Pulls Database, since even though there's a thread “search” function it's not going to give you a nice neat table of search results, just posts that you have to click into. But it provides some additional data points.

Is There a Way To Freeze a Credit Bureau's Credit Report So That Banks Use a Different Credit Bureau?

You can, although there are some caveats you should know:

- AMEX usually pulls Experian, and will often not pull from another bureau if you freeze Experian. You'll likely need to unfreeze and give access to Experian to get approved.

- Freezing means you're less likely to get lucrative targeted offers, or be able to get instant approval for offers such as the recent AMEX Platinum 100K Signup Bonus

- Freezing one bureau, such as Experian, may result in two hard pulls from the two other bureaus, rather than the one hard pull from the credit reporting agency you froze.

So What Can I Do to Minimize Credit Pulls?

While the obvious one is to reduce your absolute number of credit card applications, what most credit card churners do is to apply for multiple credit cards from the same issuer as close in time as possible, using different browsers, in order to maximize the chance of the credit pulls merging into one. Note that inquiries do *not* get combined for applications to different banks. Again, some pointers:

- Often, but not always, personal credit card applications made at the same time will merge as one inquiry (or if the bank pulls from two credit bureaus, two inquiries for the two cards, instead of four)

- Even two personal credit card applications for the same issuer made at the same time can result in two different inquiries, in particular when an issuer pulls under two different entity names. This has been reported for certain Citi and Bank of America cards.

- Personal and business credit card applications result in two different inquiries for most banks, in particular Chase, although for AMEX sometimes they are merged into one

- While some are successful at applying for 4 cards from a single issuer at once, I'd recommend 2-3, and of course having very good reasons (not just the miles or points bonus) for wanting each of the new cards.

Related Posts

Understand How Your Credit Score Works to Maximize Credit Card Rewards

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 90,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book 5-Star Hotels with Virtuoso or Four Seasons Preferred Partner Amenities!