Will opening and closing credit cards hurt your credit score? TravelSort reader Daniel comments on the Best Travel Credit Cards page:

“Lots of great insight here, thanks! I'm worried about hurting my credit score. For example, if I open the two different Citi cards you mention in #1 and then end up closing them a year or two later, won't that reflect poorly on my credit score or no? Also, it never occurred to me that Citi would let me (the same person) open up both cards at the same time. But I guess people do this all the time? (I see you suggest to wait at least a week before applying for the second one.) Thanks for your reply!”

Daniel asks a great question, and it's right to be cautious before jumping into applying for a lot of new credit cards. Before I get into his question, I'll recap some of the reasons you should NOT apply for new credit cards:

- You already have credit card or other high-interest debt

- You don't pay your credit card bill off in full every statement

- You don't have a steady income

- You plan to apply for a mortgage, refinance your house, or apply for a student loan or other major loan within the next year or so

- You're tempted to spend more by having more credit cards

But let's say none of the above apply to you–you have no credit card or high interest debt, you pay all credit cards off in full, have a steady income and hopefully some savings, having more credit cards doesn't cause you to spend more than you otherwise would, and have no plans to apply for a mortgage or any other major loan within the next year or so.

Applying for a New Credit Card

Anytime you apply for credit, whether it's mortgage shopping or a new credit card, the bank or lender will pull your credit report, called a hard pull. This does take a few points off your score, but it's not permanent–most people's credit scores recover the lost points within 6 months to a year after the pull. Also note that inquiries done at the same time can be merged; this is why many like to apply for several credit cards on the same day, in hopes that these hard credit pulls will be merged. That said, it won't work for Citi, since Citi has its own internal rules that don't permit you to be approved for more than 1 Citi card in a 7-8 day period, and no more than 2 Citi cards in 60-65 days.

Finally, as you'll see below, the additional credit line that you obtain from opening a new card can actually help your score over time given the same amount of spend, as it will give you lower credit utilization.

How is My Credit Score Calculated?

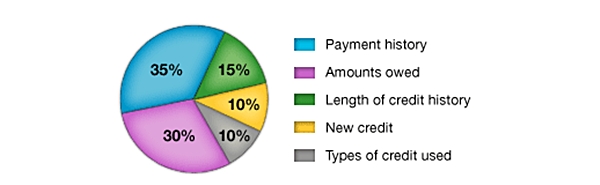

It's important to understand how your FICO is calculated. While most people understand that their payment history (paying on time, any negative financial history such as bankruptcy or delinquent debts, etc.) strongly affects their credit score, not everyone realizes that amounts owed, or credit utilization, accounts for 30% of their FICO credit score calculation.

What this means is that in addition to paying on time, you actually want to pay any large purchases down immediately, rather than waiting for the end of your billing cycle. That's because if your FICO credit score is pulled at a time when you've made a large purchase, say $10,000, and your total credit limit across your cards is $30,000, that's 33% credit utilization, which is high. Instead, aim to keep your credit utilization to 10% or less at any given time. Business cards can help with this, if most of your high expenditures are related to a business, since business credit card utilization is not taken into account by FICO; only personal credit card utilization is.

Closing a Credit Card

While closing a credit card doesn't directly knock points off your score in the same way as a hard credit pull does when applying, it can reduce your score more indirectly and over time. The two major factors at work are Amounts Owed/Credit Utilization, because when you close a card, you usually lose the credit line associated with the card, which reduces your overall credit line and results in a higher credit utilization for the same given amount of spend.

If you have another card from the bank, you can ask to transfer your credit line to the card you still plan to keep open, so as to avoid losing too much of your credit line. But also note that if you have several cards from an issuer with large lines of credit, you may be close to maxing out the credit that the bank is willing to extend to you, and this will mean you won't be instantly approved for future applications, and will need to speak to reconsideration about moving part of an existing credit line to the proposed new card you want to open. So there's a balance to be struck.

The other factor is length of credit history; a closed card can stay on your credit report for up to 10 years, but it may fall off sooner, reducing your average age of accounts. This is why I recommend having 1-2 no annual fee cards that you never close, to help with your length of credit history. And if a card more than earns its annual fee through the benefits or bonuses it provides, keep it as well. Also see

How to Decide to Close or Keep a Credit Card.

Will the Same Bank Approve Two Card Applications Made at the Same Time?

As always, it depends on the issuer and on your personal situation. I'd say that generally banks are applying more scrutiny to multiple card applications now than they did a few years ago (it used to be possible, for example, to apply for a couple Citi cards at the same time, but no longer is). It's more possible to apply for a personal and business card at the same time from Chase or AMEX (but again, not Citi). Always have thought through why you need each card, since if your online application isn't instantly approved, you may need to speak to reconsideration and answer exactly that question: why do you want this card?

Bottom Line

Each person's situation is unique, so there's no one-size-fits-all advice when it comes to credit cards and credit scores. Since there is some organization involved when it comes to meeting minimum spend and keeping track of signup, category bonuses and annual renewal dates, I recommend being thoughtful about it before jumping in, and if you have a spouse or partner, being sure they're ready for what you're embarking on.

Related Posts