Is buying Singapore miles from KrisFlyer ever worth it? Although this isn't a cheap option, it can be worth it if you just need a few more miles to top up your account, or if you need to travel on certain dates and the awards may disappear by the time you've earned Singapore KrisFlyer miles in a cheaper way.

How to Buy Singapore KrisFlyer Miles

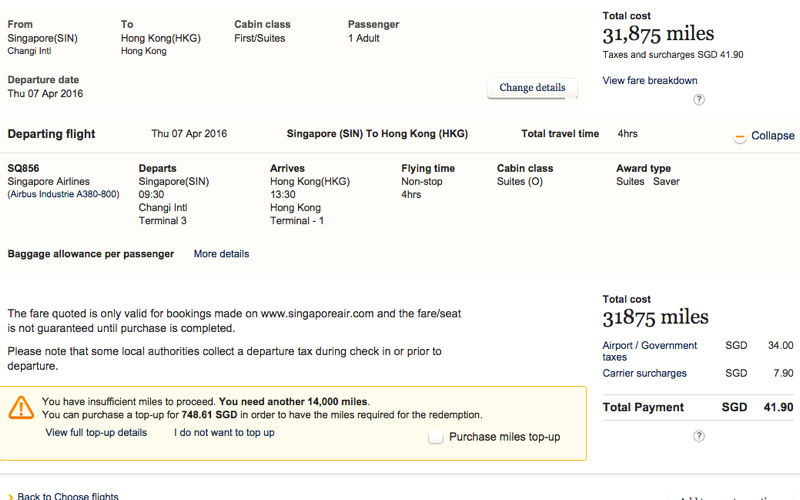

In order to buy Singapore KrisFlyer miles, you need to have in your account at least 50% of the miles required for the award you want to redeem. If you do, then when you search for the award, you'll be given the option to buy the remaining miles needed to book your award. The 50% of the miles needed is calculated based on the actual number of miles you would pay for the award, taking into account the 15% discount when booking online.

For example, let's say you have just shy of 18,000 miles in your KrisFlyer account and you want to book Singapore Suites on the A380 between Singapore and Hong Kong and check out the Singapore Private Room prior to your flight. If a Suites Saver Award is available, it will cost 31,875 miles + SGD 41.90. You would need to buy 14,000 KrisFlyer miles at a cost of SGD 748.61 (~USD $560) to book the award.

Can You Buy Singapore KrisFlyer Miles to Waitlist a Flight?

Unfortunately no. You do need to have enough KrisFlyer miles in your account for the most expensive award you waitlist, and you are not given the option to buy miles if you are only waitlisting a flight, rather than actually ticketing an award.

What If You Cancel the Award?

If you cancel an award where you bought some of the KrisFlyer miles, the miles will go back into your account. It's not an attractive option to build up miles, however, given the cost of $40 per 1000 miles, which is 4 cents per mile.

Cheapest Ways to Earn Singapore KrisFlyer Miles

If you don't fly regularly on paid Singapore Airlines tickets, the cheapest ways to earn Singapore KrisFlyer miles are with signup bonuses and category spend bonuses from U.S. credit cards that are linked in Chase Ultimate Rewards points, AMEX Membership Rewards points, or Citi ThankYou Preferred points.

The cards I'd recommend are:

- 60K Ink Plus, $95 annual fee not waived (limited time offer expires 5/25/15; see Best Travel Credit Cards in May 2015)

- 45K Sapphire Preferred, no fee first year and $95 annual fee thereafter

- AMEX Membership Rewards cards: the best offers are targeted, for example the targeted 150K AMEX Business Platinum offer or the 75K AMEX Business Gold Rewards Card offer.

- 100K Citi Prestige Card Bonus Offer (Targeted), otherwise in-branch 60K offer or 50K public offers for this card and the Citi ThankYou Premier

- Ink Plus 5X bonus for office supply store spend, including gift cards (5X on all Amazon spend, 5X on all Whole Foods spend)

- Chase Freedom 5X categories; Q2 2015 is 5X on all restaurants, so it's a great time now to stock up on gift certificates to your favorite restaurants

- AMEX Premier Rewards Gold 3X on airfare

- Sapphire Preferred 2X on all travel and hotel spend

- Chase Ultimate Rewards points: Chase says to allow up to 2 business days, but typically points transfer within 1 Singapore business day

- AMEX Membership Rewards: Allow up to 2 business days, but typically points transfer within 1 Singapore business day

- Citi ThankYou Points: Citi says to allow up to 14 (!) days for the transfer, but typically points transfer within 1-2 business days

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 200,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book 5-Star Hotels with Virtuoso or Four Seasons Preferred Partner Amenities!