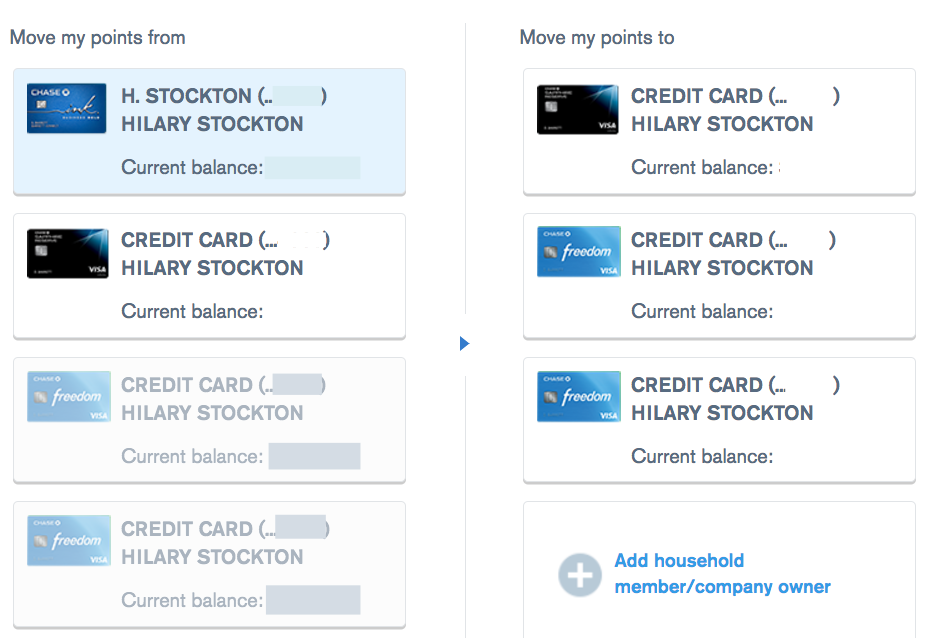

Chase is surveying clients about possible changes to Ultimate Rewards points transfers between cards, per this Reddit post. Keep in mind this is a survey only at this point, and many times the options presented never are implemented. Nevertheless, it's something to be aware of, and not a bad idea to proactively transfer your Chase Freedom or other points from your Chase no annual fee cards to your Chase Sapphire Reserve, Chase Sapphire Preferred, or Ink Business Preferred, to ensure you can transfer them 1:1 and redeem them as Ultimate Rewards points.

Here are the options Chase surveyed its customer panel on:

1. 3:2 Transfer Ratio from No Fee to Ultimate Rewards Cards

“You can combine Ultimate Rewards points on eligible Chase cards at a 3:2 conversion ratio. For example if you would like to transfer 15,000 points from your Freedom Unlimited card to your Sapphire Reserve account, your Sapphire Reserve would be credited with 10,000 points (a 3:2 ratio). The transferred points would be granted the redemption value and options of the account to which they are transferred into.”

Implication

This option would mean transferred points have all the benefits and value that they do now, once you transfer points from a no fee card such as the Chase Freedom to an Ultimate Rewards card such as the Sapphire Reserve. But as with the other options, it saves Chase money by ensuring that points earned from no annual fee cards don't transfer 1:1 to Ultimate Rewards, but rather at a 3:2 ratio. So the Chase Freedom quarterly 5X bonuses really become 3.3X, for purposes of earning Ultimate Rewards points.

2. No Fee Card Points Don't Earn a Travel Redemption Bonus

“When you combine the Ultimate Rewards points on eligible Chase cards they would retain their original redemption value–that is, when transferred the points would retain the redemption value of the product they were originally earned on. For example, you would not earn a travel redemption bonus if you transfer from a no fee card to a fee card.”

Implication

This option would most hurt anyone who often transfers their points to their Chase Sapphire Reserve account, and redeems their Ultimate Rewards points via the portal for airfare, hotels, car rentals and cruises. For anyone focused on maximizing their points redemptions, however, this wouldn't be any great loss. I've never once redeemed my points this way, and consider it a failure if I'm only getting 2 cents per mile or point in redemption value; 3 cents per mile or point is my absolute minimum and I prefer to get much more than this.

3. No Points Transfers from No Fee Cards to Ultimate Rewards

“You can only combine the Ultimate Rewards points from no fee to no fee cards and from fee to fee cards. You would not be able to combine points from a no fee to a fee card.”

Implication

This would absolutely kill the value proposition of no fee cards such as the Chase Freedom, Chase Freedom Unlimited and Ink Business Cash cards for anyone serious about earning travel rewards points. If this happened we would switch our otherwise unbonused spend from these cards to our AMEX Blue Business Plus card, since it earns 2X Membership Rewards points on all spend, and these are full fledged Membership Rewards points.

Again, currently these are merely options that Chase is surveying its customer panel about, so perhaps none of these will be implemented. But if one had to be implemented, I certainly hope it's the second one, that no fee card points don't earn a travel redemption bonus (and yet are still allowed to be transferred out to Ultimate Rewards airline partners) since the other options of non-transferability or a 3:2 ratio are much less palatable.

What do you make of Chase's survey questions on possible changes to Ultimate Rewards points transfers?

Recommended Posts

Which Travel Rewards Credit Card If You Have Just One Card?

Chase Freedom: 5X on Restaurants for Q3 2017

Chase Sapphire Reserve $300 Travel Credit Changing to Member Year from Calendar Year

100K Ultimate Rewards Points for a Chase Mortgage

Which Chase Credit Cards to Downgrade to, With No Annual Fee?

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 200,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book Your Hotel with Virtuoso or Four Seasons Preferred Partner Benefits!