When Should You Cancel a Credit Card or Pay the Annual Fee? A TravelSort Client emailed me:

“My wife's Chase Sapphire Preferred Card's annual fee just became due and that made me think of a question for you. Do you or your husband have a credit card with an annual fee that you have not canceled? I have had my Amex SPG for 4 years and my wife has had her Chase Sapphire Preferred for 2 years now. I was going to sign up for the Chase Sapphire Preferred this year and my wife was going to sign up for the SPG AMEX. Should my wife cancel her Sapphire Preferred, then I will hold a Sapphire Preferred for 2 years until she is eligible to receive the bonus again? I do not plan on cancelling my SPG Amex since I believe the bonus is once per lifetime, correct?”

Great question, which I receive in various forms on a regular basis. I usually think about this 2-3 months before the card is due for renewal for credit cards that there is a decent chance of a good retention bonus for. For cards where there's a slim to no chance of a retention bonus, I make the decision when the annual fee comes due. Here's how I think about the decision:

- Are the credit card's ongoing benefits worth paying the annual fee?

- Could I get the benefits I like (and a new signup bonus) with a different card (or from my husband getting the card)?

- Is keeping the card potentially helpful in terms of getting a new card approved by the same issuer?

- Is closing the card potentially helpful in getting better bonus offers from the issuer?

Everyone will answer these questions a bit differently, depending on how they value their cards and how they use travel credit card rewards, but in general, however you answer these questions, I'd recommend:

- Don't close your oldest credit cards: your credit history, or average age of accounts, forms about 15% of your FICO score (see Understand How Your Credit Score Works to Maximize Credit Card Rewards). While even when you close a card, it doesn't disappear immediately and can stay on your credit report for up to 10 years, you still don't want to close all of your cards.

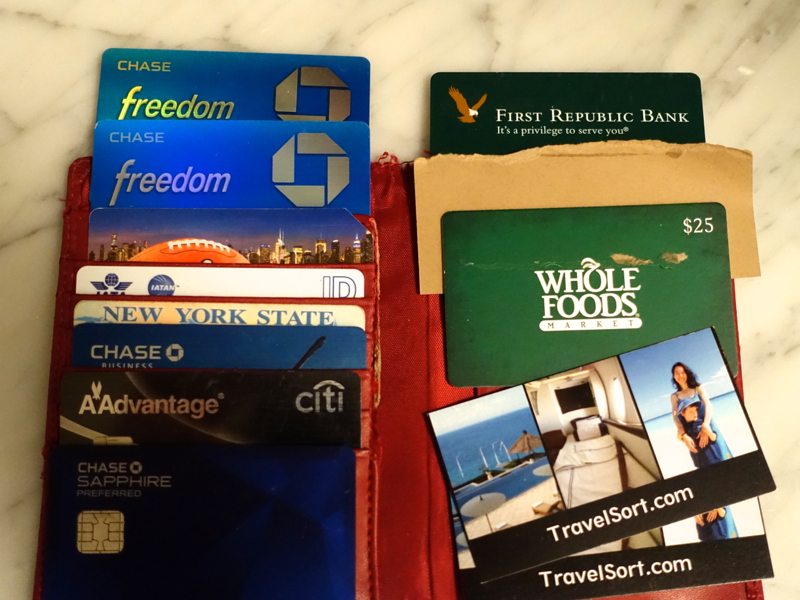

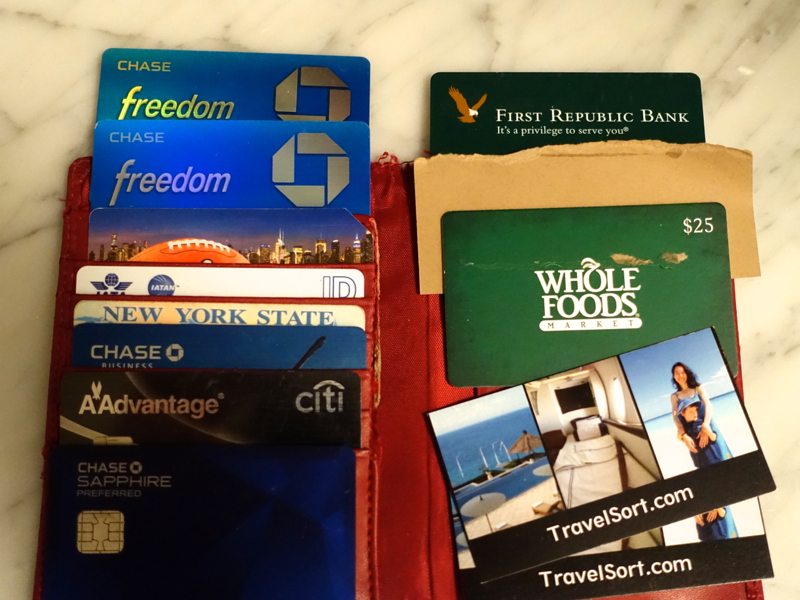

- Keep a couple no annual fee credit cards that you never close: Along those lines, you'll want to keep a couple no annual fee cards that you never close. It's helpful if it's something such as the Chase Freedom, which you use regularly for the 5X categories, so that it isn't closed by the issuer for inactivity (rare, but it does sometimes happen).

- Try for a retention bonus before closing: While I don't recommend wasting time trying for a retention bonus for the Chase Sapphire Preferred, for cards that others have received retention bonuses for (most AMEX and some Chase and Citi cards) you may want to seek a retention bonus before you close or downgrade the card

- Consider whether you want to downgrade the account or close it: Sometimes you'll just want to close the card and preserve the ability to get a signup bonus for a no annual fee card. Other times you may want to preserve the credit line or have an extra of that no annual fee card, e.g. another Chase Freedom to further maximize the 5X bonuses.

Which Credit Cards Are Worth Paying the Annual Fee For?

Of my active cards, I have paid the annual fee for four cards: Ink Plus Visa, Hyatt Visa, Citi Executive AAdvantage card and a new US Airways MasterCard, for different reasons. Here's my rationale:

Ink Plus Visa: This is my primary business card. I've held then cancelled the Ink Bold MasterCard and Ink Bold Visa before the Ink Plus Visa, but now that there is no longer an Ink Bold card, it's not as if I can get another bonus for this card, plus it's honestly easier to keep one business card that never changes. Still, I may have to revisit this closer to the 2 year mark when it would be possible to earn the bonus again for a new card, if I didn't have this existing one.

Hyatt Visa: The Hyatt Visa comes with an annual free night at a Category 4 hotel, which has come in handy for free stays at the

Park Hyatt Seoul (no longer possible as it is now a Category 5 hotel) and the

Hyatt Place Waikiki Beach. Since I find the free night and Hyatt Platinum benefits to be worth more than the annual fee, I keep the card.

Citi Executive AAdvantage: I got my current card last year when a

100K Citi Executive AAdvantage bonus with $200 statement credit was available (offer no longer available). $250 for 100K AA miles? Yes please! Unfortunately the current offer is only for 50,000 miles, with no statement credit, so not as attractive, although honestly still a better deal at less than 1 cent per mile than buying AAdvantage miles even with buy miles bonus offers.

US Airways MasterCard: If you want to receive the 50,000 bonus for this card you have to pay the $89 annual fee and make a purchase–wholly worth it for the bonus, but not necessarily worth keeping past the first year.

Chase Credit Card Strategy For Couples: Alternate Chase Cards?

Getting to the second part of my client's question, whether his wife should cancel her current Sapphire Preferred while he keeps his card, I do think alternating credit cards can be a great strategy for couples. Chase now permits you to earn a signup bonus for most of its cards as long as you have not received a signup bonus for that exact card within the past 24 months. This is great–much better than AMEX, which, as my client correctly points out, has made signup bonuses for personal AMEX cards once in a lifetime (see

AMEX Signup Bonuses Becoming Once in a Lifetime).

Because of this, it makes sense for couples to stagger signups for Chase cards–one of you gets a card such as the Chase Sapphire Preferred, with the other as an authorized user (which can be helpful for meeting minimum spend, plus maximizing category bonuses). Then, when the annual fee comes due, the authorized user applies for his/her own card, while the original cardholder either cancels or downgrades, say in this case to a Chase Freedom. The original cardholder can then become an authorized user on the partner's new card.

The only thing to note is that, due to the time between signing up and actually receiving the signup bonus, after minimum spend is met, the original cardholder wouldn't be able to signup for a second card when the partner's annual fee for the second year comes due. That's because you're ineligible if you've *received a signup bonus* within the past 24 months, and NOT if you've applied for the card within the past 24 months. A decision will need to be made as to whether to pay the annual fee on that card, or cancel/downgrade and go a few months with both partners not having the card.

Other Considerations: Will Cancelling Make It Easier or Harder to Get New Cards and Targeted Bonus Offers?

In general, you don't want to have just cancelled cards from a given issuer before trying to apply for more cards from that issuer. In the case of Citi, you may want to preserve the credit line of your existing cards, and use them to try to get approved for new cards. On the other hand, if you have a high credit line and several Citi cards, you may want to gradually winnow them down so as to have a better chance of getting instant approval on new card applications. That's because if you've already reached the maximum credit limit Citi (or another issuer) will extend to you, you won't get auto-approved for new cards–you're application will receive a “pending” message and you'll need to call reconsideration to try to get approved.

For AMEX, current long-time cardholders rarely get great new targeted offers–instead, these go to wholly new potential customers who either do not have a relationship with AMEX or are lapsed customers and haven't done business with AMEX for awhile. That's why I decided to eliminate all of my AMEX cards except one no annual fee card, and wait to see if I got any good targeted offers. It took about 1 year, but I finally did receive the 100K AMEX Business Platinum offer, which I'm convinced I wouldn't have received if I had held on to my annual fee AMEX cards. As always, YMMV.

How do you decide when to cancel a credit card or pay the annual fee?

Related Posts