There's a 140K Ritz-Carlton Rewards Visa offer, but annual fee is NOT waived, via Ben. Is this 140,000 Ritz-Carlton Rewards bonus offer worth it?

Let's look at the details of the offer, then I'll give my take, plus a FAQ based on the questions I most often get asked about the Ritz-Carlton Rewards card benefits.

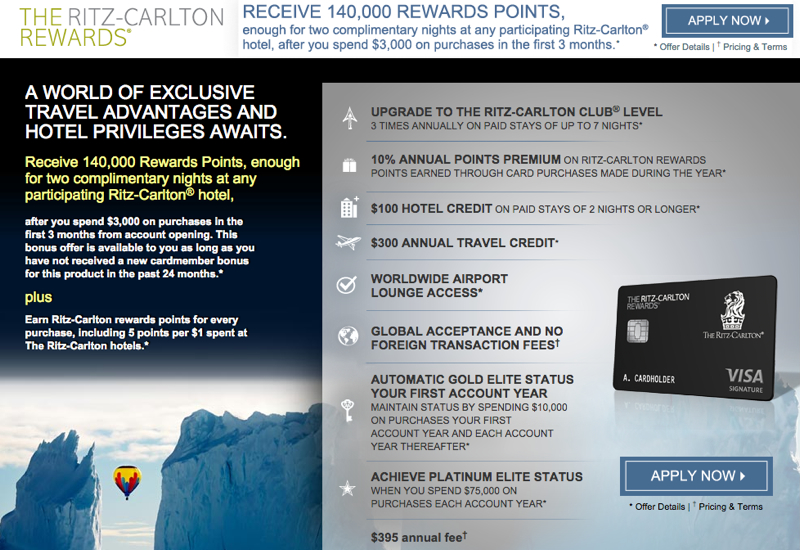

- Earn 140,000 points after spending $3000 in the first 3 months of account opening

- $395 annual fee is NOT waived the first year

- $300 travel credit per calendar year (so $600 during your first year; more analysis of this below)

- No foreign transaction fees

- Earn 5 Ritz-Carlton Rewards points per $1 charged to your guest room at participating Ritz-Carlton hotels

- Earn 2 Ritz-Carlton Rewards points per $1 spent on airline tickets purchased directly with the airline, at car rental agencies, and restaurants

- Earn 1 Ritz-Carlton Rewards point per $1 spent on all other purchases

- Automatic Gold Elite Status the first year; thereafter qualify for Gold Elite after $10,000 in purchases per account year

- $200 credit per calendar year for airline incidental (non-ticket) charges

- 24-hour JP Morgan Premier Concierge Service

- Receive a $100 hotel credit when you book a paid stay of two nights or more at participating Ritz-Carlton hotels

- Upgrade to the Ritz-Carlton Club Level on up to three paid stays of up to seven nights each by using an E-Certificate (but see restrictions as described below)

- Complimentary access to airport lounges via Lounge Club

Worth It for the 140,000 Ritz-Carlton Rewards Points?

140,000 Ritz-Carlton Rewards points is enough for a two night stay at top tier, Tier 5 Ritz-Carlton hotels, which include the Ritz-Carlton New York Central Park, Ritz-Carlton Bachelor Gulch, Ritz-Carlton Hong Kong, Ritz-Carlton Grand Cayman, Ritz-Carlton Shanghai, Pudong and Ritz-Carlton Dubai.

Lower Tier Ritz-Carltons require fewer points (60,000 for Tier 4 properties, 50,000 for Tier 3 properties, etc.) so you'd even have some points left over when booking Tier 4 or Tier 3 properties, and by earning additional points could redeem for a third free night.

It's important to note, however, that the very best Ritz-Carltons, namely the Ritz-Carlton Reserve resorts such as the Ritz-Carlton Reserve Dorado Beach and the Ritz-Carlton Reserve Phulay Bay, as well as properties such as the Ritz-Carlton Singapore, do not participate in the Ritz-Carlton Rewards program, so you won't be able to use points for award nights at any of these non-participating properties.

Bottom line: If you want to stay two nights at a Tier 5 Ritz-Carlton, the $395 annual fee is worth it.

Worth It for the $600 Travel Bonus?

To really analyze the value of this offer for those who are on the fence about paying $395 for 140,000 points, we need to look at the terms of the $300 per calendar year travel bonus. The terms explicitly do NOT permit reimbursement of airline tickets: “Only the following types of non-ticket Net Purchases qualify …”

Here are the types of travel purchases that are eligible for reimbursement per the terms (see the FAQ below for whether other types of purchases may be reimbursed in practice, even though not allowed per the terms):

- Airline lounge day pass / annual pass

- Airline seat upgrades

- Airline baggage fees

- In-flight Internet / entertainment

- In-flight meals

- Global Entry fees

Because it's much harder to get reimbursed by Chase for airline gift cards (which aren't allowed at all by the terms) than it is for the AMEX Platinum airline incidental credit (see Maximizing the AMEX Platinum Airline Fee Credit), I wouldn't assume that this is $600 in your pocket and that you'll make money from this card–it could be a struggle, particularly if you already have Global Entry, already have lounge access and waived baggage fees from elite status or your other credit cards, and don't generally pay for seat upgrades or meals.

The one allowable expense that could come in very handy is in-flight Internet, which can be VERY expensive for some international flights. Since you don't have to specify a single airline for these expenses, if you do a lot of international flying that Internet reimbursement could come in quite handy, at least if these are personal trips and not otherwise reimbursed by your employer.

FAQ

Am I Eligible for the 140K Bonus If I Previous Had the Ritz-Carlton Rewards Card?

Per the terms, yes, if you are not a current cardmember AND have not received a new cardmember bonus for the Ritz-Carlton Rewards card within the last 24 months: “This new cardmember bonus offer is not available to either (i) current cardmembers of this consumer credit card, or (ii) previous cardmembers of this consumer credit card who received a new cardmember bonus for this consumer credit card within the last 24 months.

Since these new terms don't mention the Marriott Rewards card at all, you should be eligible even if you have or had a Marriott Rewards card, although please chime in if you're a reader that is denied for this offer only on the basis of currently having or recently having a Marriott Rewards card.

Does the Travel Credit Have to Be Only for Airline Incidentals?

Per the terms, yes, see above analysis. In the past there were reports on flyertalk and elsewhere of being able to buy airline gift cards, which can then be used towards airline tickets. For example, tys90 writes “I got reimbursed for a AA gift card last year and a United gift card this year, no issues.”

Word is, though, that Chase has been tightening up, and most purchases that are not allowed per the terms will be denied, with larger denomination purchases particularly scrutinized. In some cases, Chase has investigated the purchase, and has denied reimbursement. TheFlyingScholar on Flyertalk writes “This year, I bought a $200 gift card outright. The charge apparently didn't come up as a “fee”, so they declared they'd contact United to verify. I said I would find the receipt instead, but they indeed went back to my account and notated the fee as being based on an “e-gift,” so no HUCB [hang up call back; so no reimbursement in this case].”

How Do I Receive the Travel Credit, and When Do I Get Reimbursed?

You need to contact J.P. Morgan Priority Services at the number on the back of your Ritz-Carlton Rewards card within 4 billing cycles of the purchase date and request reimbursement, so it's a bit of a hassle since there's no means to request reimbursement online.

Per the terms, statement credit will post to your account within 5-7 business days and will appear on your monthly credit card billing statement within 1-2 billing cycles.

Can the Upgrade to Ritz-Carlton Club Level Be Used in Conjunction with an Award Stay?

No, the upgrade to Ritz-Carlton Club Level is only for paid stays that are at full published rates (no corporate or promotional paid rates allowed).

Can Ritz-Carlton STARS 3rd Night Free / Fourth Night Free Offers Be Combined with the Upgrade to Ritz-Carlton Club?

No–these offers are not combinable. You would have to choose between the Ritz-Carlton STARS offer and the upgrade to Ritz-Carlton Club Level on paid stays credit card benefit.

Can the $100 Hotel Credit on Stays of 2 Nights or More Be Combined with Virtuoso Benefits?

No, these benefits cannot be combined; you would have to choose one or the other.

How Does the Ritz-Carlton Compare with Other Luxury Hotel Chains?

I'll do a more detailed post on this in the future, but, while of course properties even in the same chain vary enormously, in general I don't find Ritz-Carlton hotels to be the very best in their respective markets. If there is a Four Seasons, Peninsula, or Mandarin Oriental property in the same market, they will almost always be better than the Ritz-Carlton, with few exceptions.

Verdict: The 140K Ritz-Carlton Rewards card could be good for anyone planning a couple nights at a Tier 4 or Tier 5 Ritz-Carlton, as you'll generally come out ahead even with the $395 annual fee, at least for the first year. That said, of the major “luxury” brands I've had more clients disappointed by the Ritz-Carlton than other brands, so I don't consider it to be in the same league as Four Seasons, The Peninsula and Mandarin Oriental. The $300 per calendar year travel credit sounds great, but in practice it's a rather restricted benefit and time consuming to maximize reimbursement. I'd mainly focus on it if you end up paying significant out of pocket amounts for international in-flight WiFi, as that could be a good use.

Do you have or plan to get the Ritz-Carlton Rewards card?

Related Posts

Best Ritz-Carlton 3rd Night Free and 4th Night Free Offers

Ritz-Carlton Rewards Card 70,000 Bonus Points and $200 Gift Card Offer Worth It?

Ritz-Carlton Millenia Singapore Review

Best Marriott Hotels and Resorts to Stay at Free With the Marriott Visa

Virtuoso Confirmed Upgrades at Time of Booking: Top 10 Hotels

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 200,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book Your Hotel with Virtuoso or Four Seasons Preferred VIP Amenities!