A couple quick updates on the United MileagePlus Explorer and MileagePlus Club credit cards:

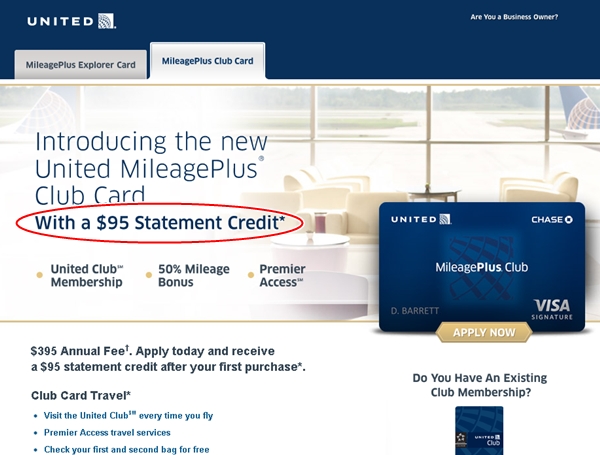

First, the bad news: there is no longer a $395 annual fee waiver for the United MileagePlus Club Card, so it's unlikely you'll be able to get matched to this offer. The best current offer is a $95 statement credit:

[United MileagePlus link has now expired]

The good news is that as of now (and as always, your mileage may vary) readers are reporting still being able to apply for the United MileagePlus Explorer card for 40,000 and be matched to the 65,000 bonus point deal, with $50 statement credit (note that this is more like a 55,000 offer, unless you spend $25K in a year to get the final 10,000 bonus points). Note that my (and other bloggers') affiliate links expire sometime today, July 2, and it's uncertain whether the general offer will change. Usually, when affiliate offers expire, the generally available offer has gone down, not up, so if you were thinking of getting this card I'd apply now.

Don't forget to take into account other Chase cards you may be interested in.

Why: Chase usually will approve one personal and one business card application made at the same time, so if you're applying for a personal card and can meet the heavy bonus spend requirements of the Ink Bold ($10K) it's a good idea to apply for the Ink Bold in conjunction with another personal card. Also see

Why: If you got in on the Visa Signature deal for trial Hyatt Platinum status, then you have 60 days from your start of your status to get the Hyatt Card as an existing Hyatt Platinum. That gets you 2 complimentary suite upgrade certificates, each good on paid stays of up to 7 nights. I plan to apply soon for this card.

Why: This offer is scheduled to end July 18, and is the highest current miles/points offer available, with up to 100,000 Avios, 50,000 of them upon first purchase. While British Airways points after last year's devaluation aren't so great for long haul flights, especially anything on British Airways that goes through London, there's still plenty of value using them for short haul flights within the U.S., U.S.-Canada or U.S.-Caribbean on AA (usually cheaper, in fact, than using American AAdvantage miles, if the flight is nonstop); intra-Europe flights, intra-Asia flights, intra-South American flights and intra-Australian flights. It's always good to have a supply of these for when these short flights would be expensive, and it's hard to sneeze at 50,000 points on first purchase.

Why: Apply before July 31 and the $95 annual fee is waived. You'll get 2 free nights including breakfast for 2 at any Fairmont destination worldwide after $1000 in spend within the first 3 months. While I probably won't apply for this, it could be a good deal for anyone who has travel plans that include a destination with a good (and expensive) Fairmont property, such as London, Paris, New York or Moscow. See Fairmont Visa Signature Card Review.

Why: The Chase Freedom is the card I use most on a daily basis, thanks to 5x category bonuses combined with Chase Exclusive bonuses (you qualify if you have a Chase checking account). The 3rd Quarter (July 1-September 30) 5x bonus is especially nice: 5x points on all dining and gas spend up to $1500. Check out Chase Freedom Rewards: Activate 3rd Quarter Bonus and Chase Exclusives Bonuses: Maximize Chase Freedom Ultimate Rewards Points

Related Posts

If you enjoyed this, please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a Member to find your perfect luxury or boutique hotel at up to 50% off: TravelSort Hotels

Disclaimer: I receive a referral for all card links in this post, except for the Fairmont Visa.