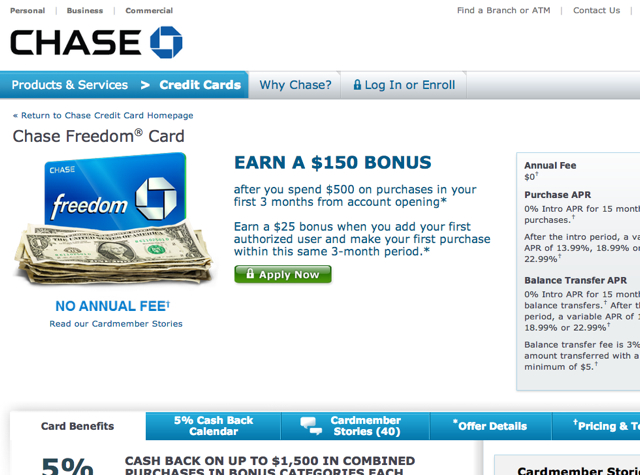

The Chase Freedom is offering up to 17,500 points from a 15,000 signup bonus and 2500 after adding an authorized user. Recently there was a 20,000 signup bonus, but the usual signup bonus for this card is only 10,000 Ultimate Rewards points, so I've updated the Best Travel Credit Cards in 2014 page to reflect this better offer.

Here are the offer details:

- Earn 15,000 points after you spend $500 on purchases in your first 3 months from account opening

- Earn 2500 points when you add your first authorized user and make your first purchase within the same 3 month period

- 5X points on up to $1500 in combined purchases in bonus categories each quarter, after you activate your quarterly bonus

- 1X on all other spend

- No annual fee

I've had the Chase Freedom longer than any of my other Chase credit cards, since it's a no annual fee card, so I'll keep it regardless of how much I use it. Here are the pros and cons as I see them for this card:

Pros

- No annual fee: No need to ever cancel this card, since there's no annual fee to pay. That helps your credit score over the long run, by increasing your average age of accounts.

- 5X on dining: My favorite 5X category by far is 5X on dining, although unfortunately it's just one quarter (this year it was Q2 2014). Just buy up gift certificates for your favorite restaurants and enjoy 5X for dining, which is even better than 3X on Chase Sapphire Preferred First Fridays.

- Transfer out to miles: While the con (see below) is that you need an annual fee card, if you have one, you can transfer out to several frequent flyer and hotel loyalty programs. I'm glad that Singapore KrisFlyer is a Chase Ultimate Rewards Transfer Partner and I also like to transfer to Korean Skypass.

- Chase Ultimate Rewards Mall: While bonuses used to be higher for a number of merchants and usually Ultimate Rewards Mall bonuses are the same for all Chase cards, it's still worth checking the Chase Freedom version of the Ultimate Rewards Mall in case the merchant offers a higher bonus than is available when clicking through from your Ink Bold or Sapphire Preferred Account.

Cons

- Low signup bonus, which is true of most no annual fee cards

- Must have a Ultimate Rewards linked annual fee card to transfer points out: You'll need a Sapphire Preferred, Ink Bold or Ink Plus in order to transfer points earned with your Chase Freedom to Ultimate Rewards airline and hotel partners, such as Singapore KrisFlyer, Korean Skypass, United MileagePlus, Hyatt Gold Passport, etc.

- 5X categories have gotten less lucrative. I no longer max out my 5X categories for some quarters, particularly when the 5X categories are gas stations and Kohl's, as they are this quarter. See 2014 Chase Freedom 5X bonuses are disappointing

- Have to activate your 5X each quarter: Look, I know you can just set an automatic alert, and that Chase is trying to encourage “engagement” with their card product, but I hate having to do this. The bonus should be automatic, as it is with virtually every other card's category bonus.

- Old Chase Exclusives Program Ended, Current One Not As Lucrative: See Goodbye Old Chase Exclusives for Freedom Card Even for Grandfathered Members

Do you have or plan to get the Chase Freedom card?

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 100,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book 5-Star Hotels with Virtuoso or Four Seasons Preferred Partner Amenities!

HT: Flyertalk