The 100,000 British Airways Visa offer is back (see link in Best Travel Credit Cards), and in light of the United devaluation it may attract more consideration than normally, although keep in mind the high spend required to earn the full bonus and companion ticket. Here are the key details:

- 50,000 Avios points with first purchase

- 25,000 Avios points after $10,000 in spend within first 12 months

- 25,000 Avios points after an additional $10,000 (total of $20,000) in spend within first 12 months

- Earn 1.25 Avios points for each $1 spend

- Earn 2.5 Avios for each $1 of British Airways spend

- Earn a Travel Together Ticket after spending $30,000 in purchases in a single calendar year (i.e. by end of 2013, or $30,000 in 2014) good for a companion ticket in conjunction with the Cardmember's reward ticket

- $95 annual fee is not waived

- Previous and existing cardmembers NOT eligible for the bonus

Is the British Airways Visa with 100,000 Bonus Avios Worth It?

First, as noted above, if you've gotten this card in the past, you're not eligible for the bonus. But what if you've never had the British Airways Visa–is it worth getting?

Worth It for 50,000 Bonus

- If you've never had this card and are eligible, the 50,000 Avios bonus points with first use are worthwhile for pretty much everyone who does some flying. The thing is, the most recent offer was 50,000 bonus Avios with the $95 first year annual fee waived, so it's unfortunate if you only plan to go for the 50,000 Avios to not have applied a few days earlier, with the first year annual fee waiver.

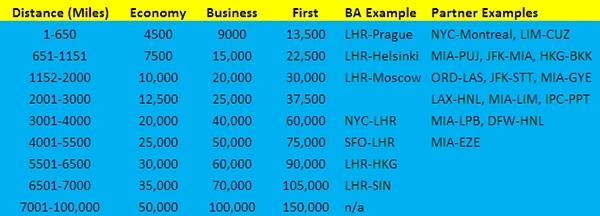

- If you don't want to pay fuel surcharges on British Airways flights, you can get good value with your Avios for short nonstop flights on American, such as NYC-Montreal for 4500 Avios in coach each way, AA flights to the Caribbean, West Coast to Hawaii awards for 12,500 Avios one way, flights on LAN to South America, and Aer Lingus flights from Boston to Ireland for 12,500 each way in coach or 25,000 each way in business class.

- To earn the full 100,000 bonus Avios points, you do need to spend a total of $20,000 within a year of opening your account, so whether it's worth it to you depends on:

- 1) BA Companion Ticket: Whether you planned to spend $30K anyway in a calendar year to get the BA Companion Ticket

- 2) Mimimum spend opportunity cost: what card bonuses would you forego by having to meet BA spend, instead of applying for and meeting minimum spend on those cards

- 3) Spend opportunity cost: what cards would you otherwise put spend on, and at what bonus level

- 4) How you value Avios points

This is probably the easiest one: if you have substantial annual spend and were planning to earn a companion ticket anyway, then the $20,000 spend to earn the other 50,000 Avios bonus points is included you your spend to attain the British Airways travel together companion ticket. Just keep in mind that you'll need to get in $30,000 in spend by the end of 2013, or, more likely, within 2014.

So if you know you won't be able to make $30,000 spend in the limited time remaining in 2013, make sure you don't put serious spend on the card until 2014, since for the companion ticket the $30,000 MUST be all in a single calendar year. Also note that the companion ticket is for flights on British Airways only, so there will be fuel surcharges. See How to Maximize the British Airways Companion Certificate on Award Tickets

The payoff is being able to fly British Airways New First Class to Europe, as we did recently this summer. It may not be as luxurious as the best Asian carriers, but the overall experience is better than U.S. airline products.

Minimum Spend Opportunity Cost

If you have high annual spend, the minimum spend opportunity cost isn't an issue, because your meeting the $20,000 minimum spend for the 50,000 bonus won't interfere with meeting minimum spend on other credit cards you may apply for, especially since you have an entire 12 months (or almost 9 months, if going for the companion ticket) to make the spend.

If, however, you spend more limited annual spend and the $30K a year is most of your total annual credit card spend, it will interfere with being able to earn a number of other signup bonuses. For example, with even just the $20,000 in spend required to earn the full bonus, you'd be able to earn the following miles and points:

|

Credit Card |

Min. Spend |

Signup Bonus |

Min. Points from Spend |

Total |

|

Citi AA World MasterCard |

$3000 |

50,000 |

3000 |

53,000 |

|

CitiBusiness AA Card |

$3000 |

50,000 |

3000 |

53,000 |

|

Hyatt Visa |

$1000 |

2 free nights |

1000 |

2 free nights + 1000 |

|

United MileagePlus Explorer (Targeted) |

$1000 |

55,000 |

1000 |

56,000 |

|

$1000 |

40,000 “miles” = $440 |

1000 |

$440 |

|

|

Mercedes Benz Platinum AMEX |

$1000 |

50,000 |

1000 |

51,000 + $200 airline fee credit/yr + $100 Global Entry credit |

|

US Airways |

$0.01 |

35,000 |

$1 |

35,000 |

|

Marriott |

$1000 |

70,000 |

1000 |

71,000 |

|

Ink Bold |

$5000 |

50,000 |

5000 |

55,000 |

|

Chase Sapphire |

$3000 |

40,000 |

3000 |

43,000 |

|

Fairmont Visa |

$1000 |

2 free nights |

1000 |

2 free nights + 1000 |

|

TOTAL |

$20,000 |

|

|

419K miles/points + 4 free nights + $440 travel credit |

Spend Opportunity Cost

How much do you currently spend, and at what level of bonus? While the best use of that $20,000 would be meeting minimum spend for credit card sign up bonuses (see above) you could also look at what that $20,000 would earn you in terms of category bonus spend.

$5000 Airline tickets: 3x using AMEX Premier Rewards Gold

$3000 Groceries: Of which, $1500 at 5x using Chase Freedom Q2 Bonus and $1500 2x using AMEX Premier Rewards Gold

$1500 Amazon spend in Q4: 5x using Chase Freedom Q3 Bonus

$5000 Other dining/Other non-airfare travel: 2x using Chase Sapphire Preferred

$5500: Other misc. spend, averaging 1.8x since some receives rewards online shopping mall bonuses, etc.

Now, of course we're mixing up AMEX Membership Rewards and Ultimate Rewards points (which are being devalued as a result of the United devaluation), which most would value a bit differently, but for the sake of simplicity let's just combine them and say this results in ~53,000 points.

For the $20,000 in spend on the British Airways Visa, meanwhile, you would have 25,000 Avios points from the spend itself (let's assume no BA Visa spend, so 1.25 Avios per $1) + 50,000 Avios bonus points, so 75,000 Avios points. So on a pure number of points level, you'd do better with the British Airways Visa.

How You Value Avios Points

Next you have to consider what Avios points are worth to you. Personally I wouldn't value them as highly as Membership Rewards points, which are more flexible and can be transferred to different partners, not to mention high fuel surcharges when using Avios to fly on British Airways. They are also worth less than Ultimate Rewards points, but by less than they used to be, due to the United devaluation.

If you value the combined 53,000 of Ultimate Rewards and Membership Rewards points at ~2 cents each, it would equate to $1060. The 75,000 British Airways Avios would be about the same value if you value each Avios at 1.4 cents each, so it comes down to if your valuation of Avios is higher or lower than that, in this example.

There are still certain pros to Avios points which make it worth it to me to hold a certain number of them:

- Award chart opens earlier than American AAdvantage, allowing a better chance of booking Cathay Pacific First Class

- Better award availability and products for first class and business class to Europe than U.S. airlines

- Good value for short, direct intra-regional flights

- No close-in booking fees for non-elites

- Low cancellation fees, making them a good backup option for awards. See Frequent Flyer Awards: Low Fee Backup Options

British Airways Concorde Room and Cabana Review

British Airways Avios Best Deals

How to Maximize the British Airways Companion Ticket

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 90,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book 5-Star Hotels with Virtuoso or Four Seasons Preferred Partner Amenities!