The 50K Lufthansa Miles & More card offer and several other offers are expiring soon, so here's a roundup, in case any of these cards or offers are ones you don't want to miss:

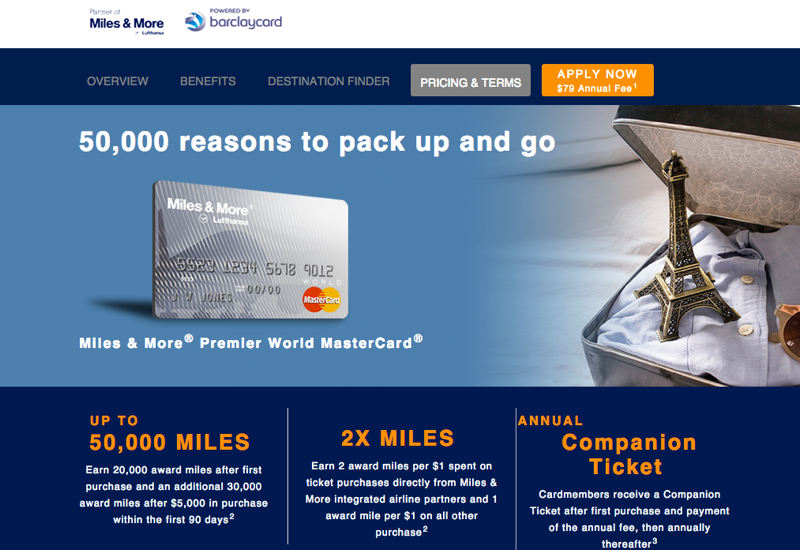

1. 50K Lufthansa Miles & More MasterCard through August 31 (see link on Best Travel Credit Cards page)

- Earn 20,000 miles after first spend, and an additional 30,000 miles after spending $5000 within the first 3 months

- Earn 2 miles per $1 spent on purchases directly from Miles & More airlines (such as Lufthansa, SWISS, Austrian Airlines, LOT Polish Airlines)

- No foreign transaction fees

- $79 annual fee is NOT waived the first year EXCEPT for Miles & More Senator and HON Circle members, as long as they maintain their elite status

My Take: Having just redeemed most of our existing Miles and More miles for two Lufthansa First Class awards for travel next year, we decided to apply for this card for my husband. Paired with some transferred SPG points, this will give us the option of another Lufthansa First Class one way award on a future trip to or from Europe. The $5000 minimum spend is significant, so it did give us pause, but at the end of the day I value Miles & More miles around 2 cents per mile, so that's over $900 worth of value taking into account the $79 annual fee.

2. 50K British Airways Visa with Annual Fee Waived through August 31

- 50,000 bonus Avios after $2,000 spend within the first 3 months of account opening

- 3 Avios for every $1 spent on British Airways purchases and 1 Avios for every $1 spent on all other purchases

- Smart Chip Technology

- No foreign transaction fees

- Travel Together companion ticket valid for 2 years after $30,000 spend within a calendar year

- $95 annual fee is waived for the first year

My Take: Normally the $95 annual fee is not waived for this card, so while I don't expect the 50K signup bonus to change after August 31, I do expect the annual fee to return. Before the new Avios devaluation I would have almost automatically signed up for this card, since $2000 minimum spend isn't that much, and Avios can be useful in our family for getting one of us to or from Europe, or even further afield, in a pinch. But with the devaluation I think we likely won't reapply for this card, although we'd both qualify for the signup bonus as we last had this card well over 2 years ago.

3. Transfer 20K SPG Points into 30K American AAdvantage Miles through August 31

- Transfer in increments of 20,000 SPG points to receive 30,000 AAdvantage miles per 20K SPG points transferred

- Transfer until 11:59pm CT August 31

- Transfer maximum of 60,000 Starpoints (=90,000 AAdvantage miles) within a 24 hour period

- Allow 7 business days after transfer for miles to post to AAdvantage

- Must have idential member names for SPG and AAdvantage accounts

My Take: If you have tons of SPG Starpoints this could be a good transfer opportunity, especially as it's become harder to earn AAdvantage miles through credit card bonuses. We won't be doing this, however, as we don't have many Starpoints and have earmarked them for transfers to Miles & More, to top up accounts and redeem for Lufthansa First Class.

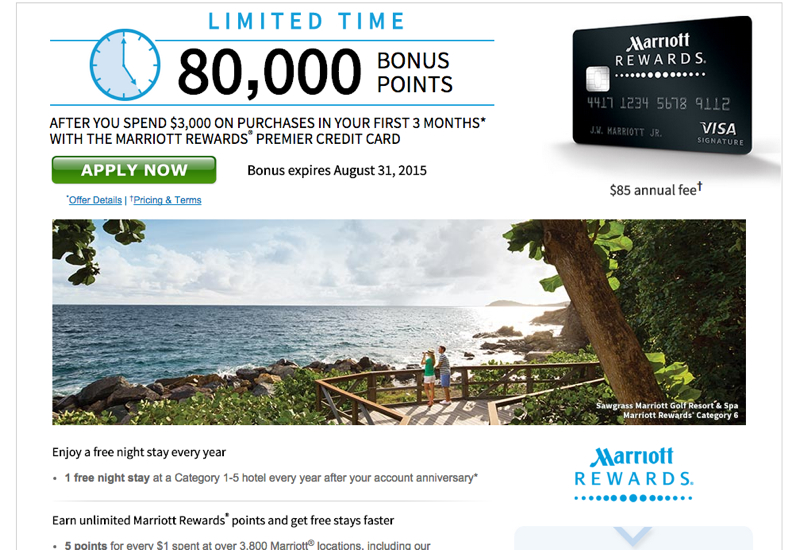

4. 80K Marriott Visa through August 31

- 80,000 Marriott Rewards points after spending $3000 within your first 3 months of card membership

- 1 free night at a Category 1-5 Marriott on your account anniversary

- 5 points per $1 spent at Marriott and Ritz-Carlton hotels

- 2 points per $1 spent directly with airlines, car rental locations and restaurants

- 1 point per $1 on all other spend

- 15 credits towards Elite status after account approval and on every account anniversary

- No foreign transaction fees

- $85 annual fee is NOT waived the first year

Do you plan to take advantage of any of these or other soon to expire offers?

Related Posts

Best Ways to Use Lufthansa Miles and More Award Chart

Our 2015 Progress Towards 1 Million Frequent Flyer Miles and Points

New British Airways Avios Devaluation

Redeeming 800K Miles and Points: Why We Don't Save Our Miles

How to Decide to Close or Keep a Credit Card?

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 200,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book 5-Star Hotels with Virtuoso or Four Seasons Preferred Partner Amenities

Editorial Disclosure: The editorial content on this site is not provided by the companies whose products are featured. Any opinions, analyses, reviews or evaluations provided here are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by the Advertiser.