Which travel credit cards are we planning to apply for now? We're nearing the end of the $20K minimum spend for our 150K AMEX Business Platinum targeted offer, so I'm now looking at which travel credit cards to apply for next. I don't know about you, but I wince whenever I have unbonused spend going on an existing credit card, which only gets 1 mile or point per dollar, instead of a card I'm working on minimum spend for.

By way of background, we highly value AAdvantage miles and KrisFlyer miles as well as points that transfer to them. We already have cards such as the Citi AAdvantage Platinum Select, Ink Plus, AMEX Business Platinum, US Air MasterCard, Sapphire Preferred and Chase Freedom. We've recently had the Citi Executive AAdvantage card, and also aren't eligible for the 50K AMEX Premier Rewards Gold since AMEX personal cards are now once in a lifetime. Given the New British Airways Avios Devaluation the British Airways Visa is low priority for us, even though we'd be eligible to apply for it again.

These are the cards I'm currently considering for us:

Offer:

- 50K ThankYou points after $3000 spend within the first 3 months

- 3X ThankYou points on travel

- 2X ThankYou points on dining out and entertainment

- No foreign transaction fees

- No annual fee the first year, thereafter $95 per year

The Citi ThankYou Premier card is meant to compete with mid-range cards such as the AMEX Premier Rewards Gold and the Chase Sapphire Preferred. I don't value Citi ThankYou points quite as highly as either Membership Rewards or Chase Ultimate Rewards, since the only transfer partner I value is Singapore KrisFlyer. Nevertheless, $3000 minimum spend isn't bad for picking up 50K KrisFlyer miles, and the no foreign transaction fees make it easier to do with this card than with the AMEX Business Gold card below. Plus, no annual fee the first year, and I like that there's 3X on travel, which includes airlines, hotels, car rentals, travel agencies, taxis, railways, tolls, parking garages, gas stations, etc., which bests the Sapphire Preferred's 2X.

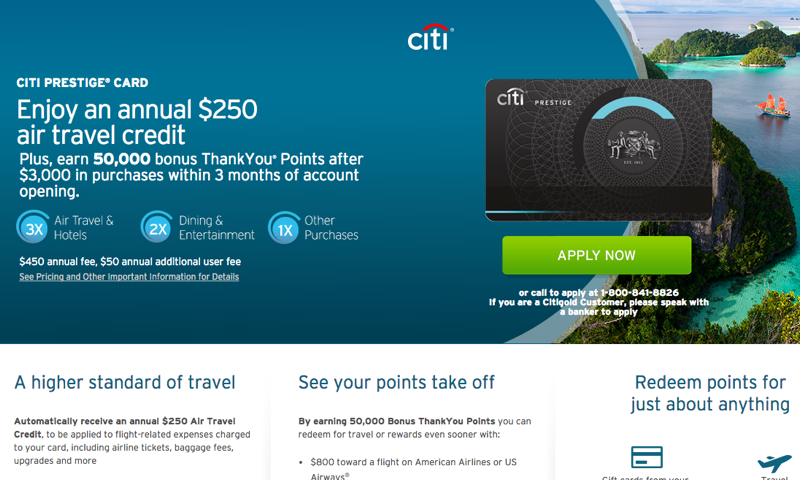

2. 60K or 50K Citi Prestige

60K Citi Branch Offer

- 30K ThankYou points after $3000 spend within the first 3 months

- Additional 30K ThankYou points after $12,000 additional spend within 12 months (so 60K points for $15,000 spend)

- $250 air travel credit each year

- Access to American Airlines Admirals Club lounges

- No foreign transaction fee

- $350 annual fee is NOT waived

50K Public Offer

- 50K ThankYou points after $3000 spend in the first 3 months

- $250 air travel credit each year

- Access to American Airlines Admirals Club lounges

- No foreign transaction fee

- $450 annual fee is NOT waived

Sure, I would love to receive a targeted 100K Citi Prestige offer (and if you're targeted for the 100K bonus, I encourage you to apply for it), but I'm not optimistic of it happening, since, unlike with AMEX, I've had a number of Citi credit cards in the past year and have one now. In my view, this is a card to get for the first year of benefits, namely the $500 in air travel credits, then cancel. Since we'll have several paid air tickets this year and next, it could be worth it for both my husband and I to get the card since we'll definitely use the $500 in air travel credit the first year, coming out 50K points and $50 ahead with the 50K offer, even ignoring the Admirals Club lounge benefit, which we don't value that much.

Given the significant spend that accompanies the in-branch 60K offer, we likely won't take that one, especially since we wouldn't be keeping the card beyond the first year anyway, so the $100 lower annual fee isn't much of a loss.

3. 50K United MileagePlus Explorer Business Card

Offer:

- 50,000 United MileagePlus miles after $2000 spend within the first 3 months

- 2 miles per dollar on United Airlines spend and on restaurants, gas stations and office supply store purchases

- 2 United Club passes per year

- No foreign transaction fees

- No annual fee the first year thereafter $95 per year

It's a bit hard to get excited about United miles ever since the massive United Award Chart Devaluation that bifurcated award redemption rates and made international partner awards such as SWISS Business Class, Lufthansa First Class, Asiana First Class, etc. incredibly expensive. Because of this I'm also loathe to transfer any Chase Ultimate Rewards points to United, and prefer to transfer to Singapore KrisFlyer or Korean SkyPass instead. All the same, there are occasionally times when a United award makes sense, such as United BusinessFirst to Hawaii, and United Club passes can come in handy as well, so I should probably pick up 50,000 United miles for the reasonable minimum spend.

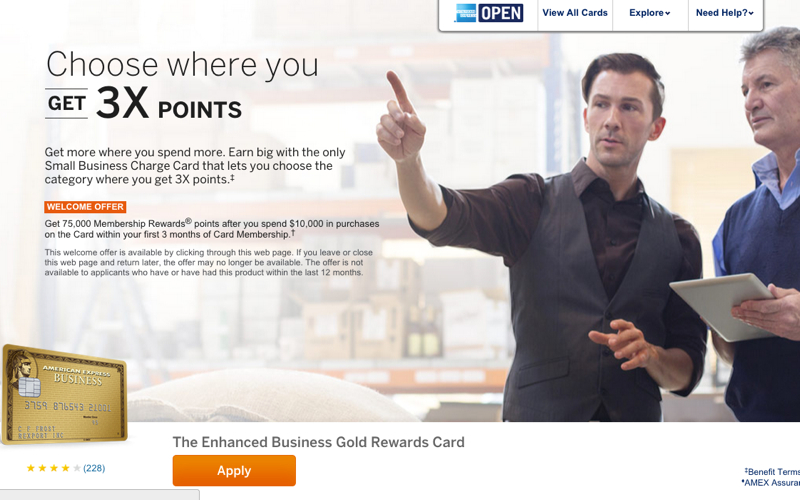

4. 75K AMEX Business Gold Rewards Card

Offer:

- 75,000 Membership Rewards points after $10,000 spend within the first 3 months

- 3X on your choice of airfare purchased directly from airlines; advertising in select media; gas station spend; U.S. shipping; or U.S. computer hardware, software and cloud computing purchases from select providers

- No annual fee the first year, thereafter $175 per year

I would likely place this card higher on my priority list if we weren't finishing up $20K in spend and if this card didn't charge foreign transaction fees. Quite a bit of my spend is abroad, so the forex fees are a killer, and unlike the personal version of this card, the AMEX Premier Rewards Gold card, which effective June 1, 2015 does not charge foreign transaction fees, the Business Gold Rewards card still does.

Which new travel credit cards do you plan to apply for?

Related Posts

100K Citi Prestige Card Bonus Offer (Targeted)

75K AMEX Business Gold Rewards and 75K AMEX Business Platinum Bonus Offers

How We Earned 1 Million Miles and Points This Year

TravelSort Award Booking Service

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel or cruise through us.

If you enjoyed this, join 200,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book 5-Star Hotels with Virtuoso or Four Seasons Preferred Partner Amenities!