Update: As I mentioned in an August 5 Tweet, Chase has stopped allowing online purchases of points. This was never a very lucrative option anyway–as I suggested, you're better off simply buying $1000 in gift cards (think Amazon 5X) to earn those 5000 points, without any fee whatsoever if these are Amazon or other retailer gift cards.

——Original Post—–

TravelSort reader Jim asks “I read somewhere you can buy Ultimate Rewards points, but how does it work, and is it worth it?”

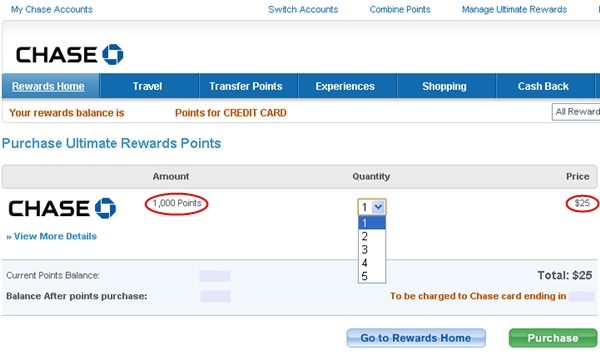

You can buy Ultimate Rewards points in increments of 1000 for $25, up to a total of 5000 per month for $125, which works out to 2.5 cents per point. Here's a step by step of how to buy Ultimate Rewards points, before we get into whether it's worth it:

How to Buy Ultimate Rewards Points

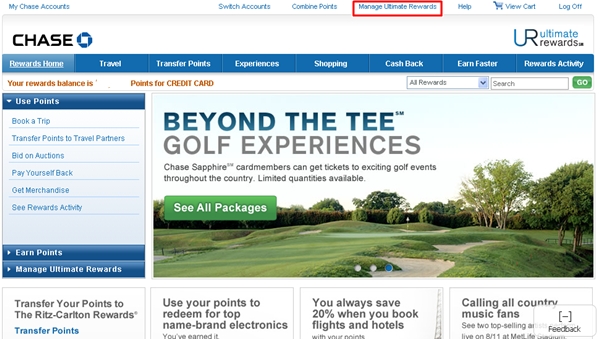

1. Log into your Ultimate Rewards Account, then click on “Manage Ultimate Rewards”

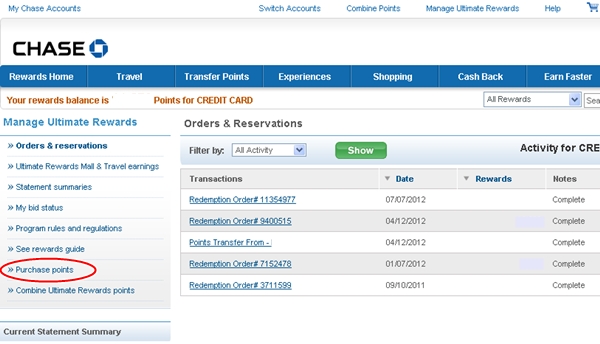

2. In the left hand column, click on “Purchase Points”

3. You can now select from the dropdown how many points you want to purchase: 1000 points for $25, 2000 points for $50, etc. up to 5000 points for $125:

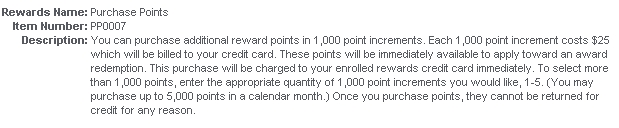

You can click on “View More Details” to see the terms: points will be instantly available to use for award redemptions, and as usual points purchases are not refundable:

But is buying points ever worth it?

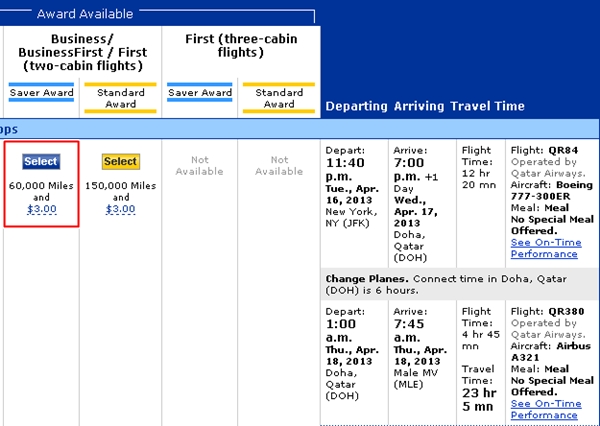

It could be, to top up your balances if you just need a few more points and want to redeem right away for a reward. For example, if you have 58,000 Ultimate Rewards points and want to redeem for a one-way award from NYC to the Maldives (MLE) in business class on Qatar, which is 60,000 United miles = 60,000 Ultimate Rewards points:

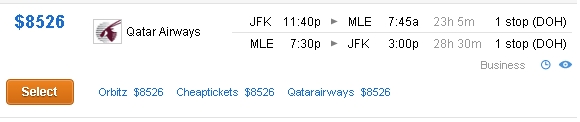

Those extra 2000 points would just cost you $50, on a ticket that retails for over $4000 (roundtrip is over $8000):

That means that your one-way award for 60,000 United miles = 60,000 Ultimate Rewards points is getting you over 7 cents per point nominal value. What if you would only ever pay $3500 roundtrip for business class in Qatar, so $1750 one-way? Well, that's still 2.9 cents per point, which is better than 2.5 cents per point for that 2000 point purchase, plus you presumably got the other 58,000 Ultimate Rewards points much more cheaply, via credit card signups and spend bonuses.

So I'd say that's worth it, especially since it takes time for Ultimate Rewards points to post to your account, and unlike AMEX Membership Rewards points, you can't do a points advance.

On the other hand, if you're planning to redeem for a domestic coach ticket, most times it won't be worth it, since these are cheaper tickets. Ultimately, whether it's worth it will depend on your redemption and how you value the award: the highest value redemption will always be transferring to United miles and booking business or first class international travel, where you highly value this type of travel.

If you do have more time available to build up your points balances and/or you need more points (since 5000 points per month isn't much) these are more economical ways of building up your Ultimate Rewards points:

1. 50,000 Points: Apply for the Ink Bold or Apply for the Ink Plus

The Ink Bold is a business charge card (you must pay in full every month) and the Ink Plus is a business credit card (you should still pay in full though and avoid carrying a balance), but both are for anyone who has or is planning some kind of small business, such as an Amazon, eBay or Etsy store; a consulting business; house or apartment rentals, or even a side “hobby” business. It's good to be able to separate your business or business planning expenses, come tax time, and you do not need to be incorporated or an LLC to apply. See Ink Bold Signup Tips

2. 40,000 Points: Apply for the Sapphire Preferred

In just over a year the Sapphire Preferred has become the must-have travel credit card. Unless you're using the AMEX Prepaid refilled using the Ink Bold, you won't find a better travel card to use overseas, since there are no foreign transaction fees and the Sapphire Preferred offers 2X for all travel and dining. See Best No Foreign Transaction Fee Cards

3. 25,000 Points: Apply for the Ink Classic

If you already have the Ink Bold, you can still get the Ink Classic, for an additional 25,000 Ultimate Rewards points: 10,000 after first purchase and an additional 15,000 points after spending $5000 in the first 3 months. See Maximizing the Chase Ink Bold: How to Meet Minimum Spend since our advice there also applies to the Ink Classic. The benefit of the Ink Classic vs. the Ink Bold is that there's no annual fee, so as long as you have the Sapphire Preferred so that you have a way of transferring points out to United, Hyatt and other Ultimate Rewards partners, this could be the business card that you keep open, to help keep credit utilization low and improve average age of accounts for a better credit score.

4. Use Your Ink Bold or Ink Classic to Purchase Gift Cards

Since the Ink Bold and Ink Classic offer 5X for office supply store spend, you can use them at some Office Depot stores to purchase gift cards, including $500 Visa gift cards. Do call the Office Depot first, since some are not allowing you to use credit cards to purchase these gift cards, citing fraud, while some do still allow it. You can also go to Office Max to get Amazon gift cards. Unlike Visa gift cards, there's no fee, and it's convenient because you can simply load up all the gift cards to your Amazon account. That's the equivalent of getting 5X off of all Amazon spend–see 5X Points for All Amazon Spend. Note that you should not go overboard on this, since Chase has been known to shut people down for abuse. Make sure that you're also putting 2X and some other business spend on the card, not just 5X spend.

5. Max Out 5X Quarterly Bonuses Using Your Chase Freedom

Ah, the Freedom–the card I use the most often on a daily basis, thanks to great 5X bonus categories. This quarter, July-September 2012, the 5X categories are dining and gas, so my family and I have been happily putting all dining spend on the Freedom, including NYC Restaurant Week deals. Up to $1500 in quarterly spend receives the 5X bonus, so if you max out the 5X bonus for each quarter, that's 30,000 Ultimate Rewards Points for the year, plus all other bonus points from Chase Exclusives. Not too shabby for a no annual fee card!

6. Get Chase Exclusives Bonuses with Your Chase Freedom

If you have a Chase checking account, you'll get extra Chase Exclusives bonuses of 10% on base spend and 10 extra points per transaction when using your Chase Freedom. That means that I put ALL small purchases on the Freedom in addition to the 5X category spend–check out our Freedom vs. Sapphire Preferred vs. Ink Bold comparison chart

Related posts

5X Points for All Amazon Spend

Chase Exclusives Bonuses: Maximize Chase Freedom Ultimate Rewards

Book Qatar to the Maldives with United Miles Before It's Too Late

Check out and apply for the Best Travel Credit Cards.

If you enjoyed this, please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a Member to find your perfect luxury or boutique hotel at up to 50% off: TravelSort Hotels