If a 100K AMEX Business Platinum offer arrives but is targeted to another person, can you apply? TravelSort reader Karen writes “I recently moved and sometimes receive junk mail addressed to the previous tenant. But just today, I noticed a 100K AMEX Business Platinum offer addressed to him. Can I apply for it instead, since I have a business? Or is the offer only valid for the person it's addressed to?”

Karen was kind enough to send photos of the targeted 100K AMEX Business Platinum offer, which is a very good one, although some (my family included) have been targeted for the even higher 150K AMEX Business Platinum bonus offer. Here's the 100K bonus offer she received:

- Earn 100,000 AMEX Membership Rewards points after spending $10,000 on qualifying purchases within the first 3 months of card membership

- $200 airline incidental fee credit per calendar year

- $100 Global Entry statement credit

- Complimentary access to the Centurion Lounges, international American Express Lounges, Priority Pass Select lounges, Delta SkyClub (must be traveling on a same day Delta operated flight), Airspace Lounges

- No foreign transaction fees

- $450 annual fee (not waived)

You CAN Use Someone Else's Targeted offer for an AMEX Business Platinum Card

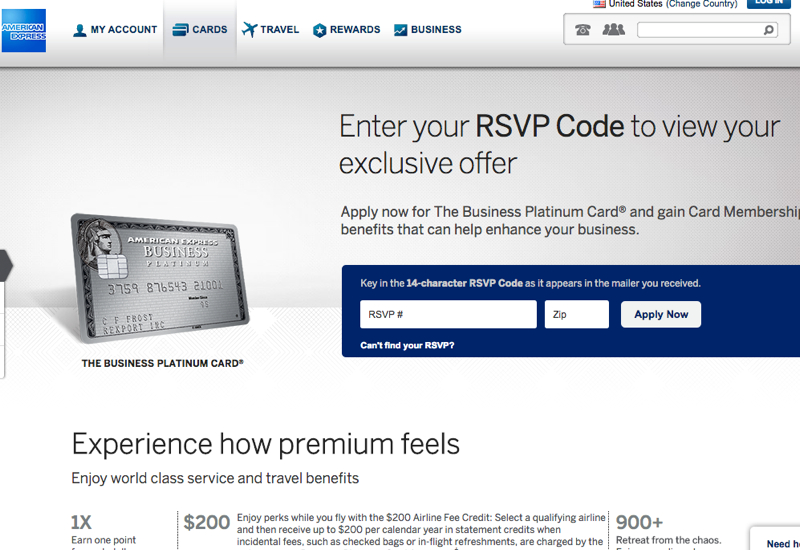

AMEX targeted offers have an RSVP code, valid for one-time use. For targeted AMEX Business Platinum bonus offers, go to

OPEN.COM/GETPLATINUM and enter the RSVP code listed on the offer. You won't always see the actual Membership Rewards bonus points offer on the application page, but you can confirm the offer once approved, or instead call 800-971-6736 if you prefer to apply by phone.

If this was an AMEX Business Platinum targeted offer, you'll notice that while the business name and address are pre-populated, it's possible to delete them and enter in a different business name and address.

But Typically You Can't Use Another Person's Targeted Offer for a Personal AMEX Card

Note, however, that if you happened to receive someone else's targeted offer for an AMEX personal card, such as an AMEX Platinum or AMEX Premier Rewards Gold card, typically the name field is hard coded and you can't change it.

Remember That AMEX Signup Bonuses Are Once in a Lifetime

You Can Use the $100 Global Entry Statement Credit for Another Person

As long as you charge the Global Entry statement credit to your AMEX Business Platinum, you can receive the $100 statement credit; it need not be for your own Global Entry membership. This can be handy if you already have Global Entry but also need it for a family member or a business colleague.

The $200 Airline Fee Credit Cannot Be Used for Direct Ticket Purchases, But There Are Ways to Maximize It

The $200 airline fee credit is officially an incidental credit, which will only reimburse you for fees such as checked baggage, in-flight food purchases and airline lounge day pass fees if billed directly by the airline, and the like. It cannot be used towards actual ticket purchases.

Is it Worth Getting the AMEX Business Platinum?

Absolutely, if your signup bonus is 100K or 150K and if you can meet the minimum spend in time to earn the signup bonus. It's a harder question as to whether it's worth keeping the card after the first year, especially as the card has no category bonuses, and the airline incidental credit is more of a pain to use than the Citi Prestige, for example. But Membership Rewards points, in my view, are also more valuable than Citi ThankYou points. Also see:

Cancel the Citi Prestige or AMEX Platinum Card?

Have you ever applied for an AMEX Business card targeted to another person or business?

Related Posts