There's now an offer for the Ritz-Carlton credit card that offers 70,000 points and waives the $395 annual fee, if you apply by July 25, 2012 (note that this not a referral link for me; but it is currently the best offer). It does appear to be targeted to Ritz-Carlton residence owners. So, while I'd love to be able to promise that if you apply you'll get it, I think this is a “your mileage may vary” opportunity. Would love to hear from anyone if you successfully applied for the offer and you're not a Ritz-Carlton residence owner.

In any case, since this card has been around for awhile with 50,000 bonus points, I figured it's time to review it. First, here's what you get:

Ritz-Carlton Credit Card Benefits

- Earn 70,000 points after your first card use

- $395 annual fee is waived the first year

- No foreign transaction fees

- Earn 5 Ritz-Carlton Rewards points per $1 charged to your guest room at participating Ritz-Carlton hotels

- Earn 2 Ritz-Carlton Rewards points per $1 spent on airline tickets purchased directly with the airline, at car rental agencies, and restaurants

- Earn 1 Ritz-Carlton Rewards point per $1 spent on all other purchases

- Automatic Gold Elite Status the first year; thereafter qualify for Gold Elite after $10,000 in purchases per account year

- $200 credit per calendar year for airline incidental (non-ticket) charges

- 24-hour JP Morgan Premier Concierge Service

- Receive a $100 hotel credit when you book a paid stay of two nights or more at participating Ritz-Carlton hotels

- Upgrade to the Ritz-Carlton Club Level on up to three paid stays of up to seven nights each by using an E-Certificate

- Complimentary access to airport lounges via Lounge Club

Pros

Sure, no foreign transaction fees is nice, but doesn't differentiate this card from the Ink Bold, Sapphire Preferred, Hyatt Visa, British Airways Visa, and a number of other cards that also don't charge foreign transaction fees. Here are the more important true benefits:

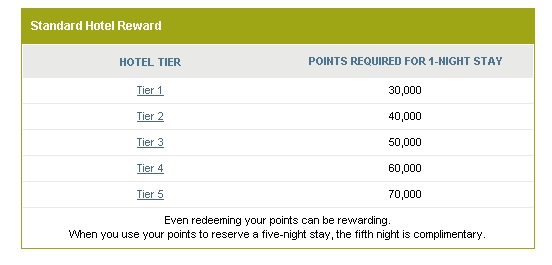

- 70,000 points is enough for 2 free nights at lower tier Ritz-Carlton hotels and 1 free night at top-tier Ritz-Carlton hotels (see Ritz-Carlton Rewards discussion below)

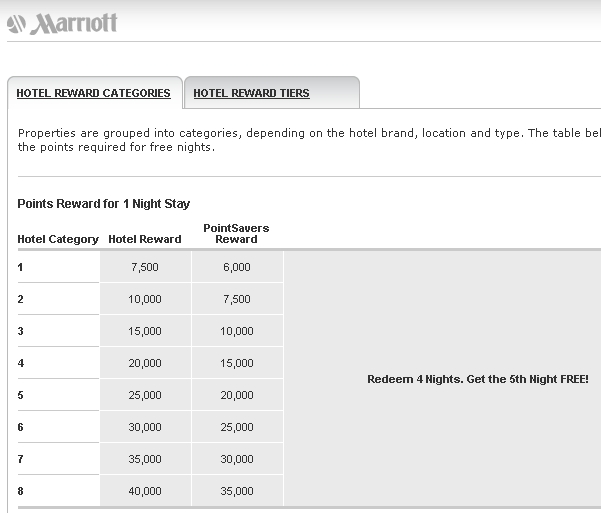

- You could instead use the 70,000 points for Marriott properties, which would get you 2 nights in all Marriott hotels up to Category 7, or all Marriott hotels including Category 8 if you're able to use PointSavers

- Annual fee waived for the first year is a big deal–many wouldn't even consider this card with the $395 annual fee

- $200 airline incidental credit may be used for ANY airline, unlike the the AMEX Platinum, which requires you to choose only one airline to use the airline credit on

- 24-hour JP Morgan Premier Concierge Service: while I don't have personal experience with it, all reviews I've seen of it indicate this is very high quality

- Gold Elite status: room upgrade on availability, complimentary Internet, 25% bonus on base points when staying at the Ritz-Carlton

- Gold Elite status arguably even more valuable if you regularly stay in Marriott hotels, as it gets you free breakfast and lounge access. See How to Compare Hotel Programs' Mid-Tier Elite Benefits, where as Ben noted, Marriott Gold is closer to top-tier elite status in other hotel programs. You'd get that status free the first year with the Ritz-Carlton Credit Card, and after $10,000 in card spend in subsequent years, if you keep the card.

- 5x points for dining and other on-property spend at the Ritz-Carlton is only if you are also a guest at the Ritz-Carlton; you must be able to bill it to your guest room. No 5x point bonus if you are simply dining at a Ritz-Carlton restaurant but not staying there.

- Gold Elite status will *not* get you any upgrades to the Club Lounge, or any suite upgrades

- The Club Level upgrades are only for paid stays, and cannot be combined with any other offer, such as corporate rates, association AMEX Fine Hotel and Resort benefits, etc. That means you'll be paying full rack rate, in order to use these upgrades. In some cases, you would get a better rate for a club room by using a corporate or association (AAA, etc.) discounted rate or a package rate.

- Club Level upgrades are capacity controlled, so just because there are still Club Level rooms does not mean you'll definitely be able to use one of your paid stay upgrades.

- You won't be able to apply an upgrade to an existing reservation; it would need to be rebooked, and at a higher fee if your original rate is no longer available.

- Airline incidental don't include airline club membership fees; they only include baggagge fees, food purchased on board, and club day passes. So if you're a frequent flyer elite member and never pay checked baggage fees or for food on board or for airline lounge day passes, you may have trouble using your $200 credit

- You need to actually contact JP Morgan Priority Services at the phone number on the back of your credit card within 4 billing cycles of the date of your airline incidentals charge to receive the credit. A secure message to Chase should work, but don't expect any credit to be posted automatically

- Ritz-Carlton hotels are categorized as Tier 1, Tier 2, Tier 3, Tier 4, or Tier 5, with Tier 1 hotels the cheapest to redeem a reward for, and Tier 5 the most expensive:

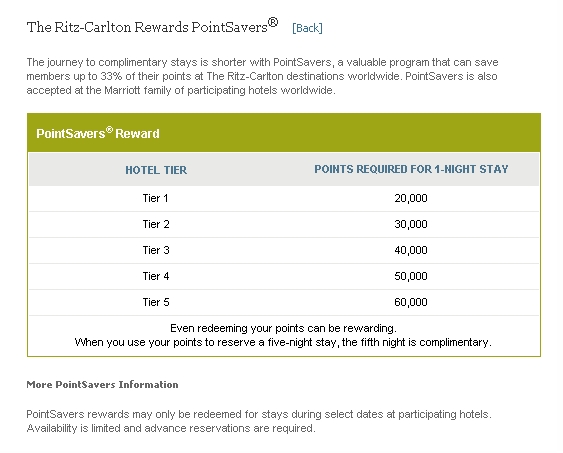

- There are also PointSavers awards, which reduce the Ritz-Carlton Rewards points needed. The bad news is that you'll need to call the hotel to figure out when they're offered, as they are subject to availability and unlikely to be available during peak times.

- If you book a 4 night award, you can get the fifth night free

- A few of our favorite Ritz-Carltons to use your reward points at (listed alphabetically):

- Hotel Arts Barcelona (Tier 3)

- Ritz-Carlton Half Moon Bay (Tier 3)

- Ritz-Carlton Moscow (Tier 3)

- Ritz-Carlton Shanghai Pudong (Tier 5)

- Ritz-Carlton Tokyo (Tier 3)

- Marriott hotels fall into one of 8 categories, with Category 1 hotels the cheapest to redeem a reward for, and Category 8 hotels the most expensive. As with the Ritz-Carlton, there are PointSavers Rewards that can bring the number of points down. See How to Book PointSavers

- If you book a 4 night award, you can get the fifth night free

- A few of our favorite Marriott hotels to use your Ritz-Carlton points at (listed alphabetically):

- Boscolo Budapest (Category 6)

- Hotel Beaux Arts, Miami (Category 7)

- Paris Marriott Champs-Elysees (Category 8)

- Renaissance Paris Arc de Triomphe (Category 8)

- Rome Marriott Grand Hotel Flora (Category 8)

- Zurich Marriott (Category 8)

Check out and apply for the Best Travel Credit Cards.

If you enjoyed this, please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a Member to find your perfect luxury or boutique hotel at up to 50% off: TravelSort Hotels