Update: Note that there is a 100K Citi Executive AAdvantage Offer with $200 statement credit

The Citi Executive AAdvantage Card offers a 60,000 miles bonus, for a $450 fee (not waived). That's equivalent to buying AAdvantage miles at 0.0075 cents per mile, less than 1 cent per mile. Of course, if you don't yet have any Citi AAdvantage cards, I recommend you take advantage of the 50,000 AAdvantage offers for personal Citi Platinum Select Visa and the business CitiBusiness AAdvantage MasterCard on the Best Travel Credit Cards page, as these waive the first year annual fee.

Nevertheless, the Citi Executive AA MasterCard could be worth it if you've already applied for the other Citi AAdvantage cards that waive the first year annual fee and need more AA miles, with a huge caveat: in the fine print terms and conditions it says “This Citi® / AAdvantage® card offer is only valid for new applicants for a Citi® / AAdvantage® account applied for pursuant to this offer and is not available to existing cardmembers or recent applicants for a Citi® / AAdvantage® credit card.” It's a completely different product from the other Citi AAdvantage personal cards, so I do think many will be able to earn the bonus in spite of having other Citi cards, but the terms are pretty clear, so proceed at your own risk.

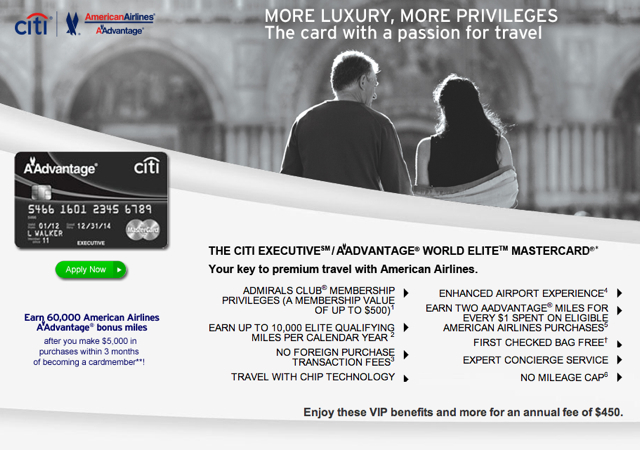

First, the details for the Citi Executive AAdvantage Card:

- Earn 60,000 AAdvantage miles after $5000 in spend within the first 3 months

- Earn 2 AAdvantage miles per dollar spent

- First checked bag free

- Priority check-in, priority security screening, priority boarding

- No foreign transaction fees

- Chip and signature card

- Annual fee of $450 is NOT waived

- US Airways MasterCard 35,000 Miles [Update: Offer is Dead; removed link from credit cards page]: 35,000 bonus miles after first spend. See link on the Best Travel Credit Cards page. Note that if you already have this card, you are likely to be denied, but if you don't yet have it, now is the time to get it, since this will be going away due to the American and US Airways Merger moving forward.

- Lufthansa Miles & More Card 50,000 Miles [Update: Offer is Dead]: 20,000 miles after first spend, and another 30,000 miles after spending $5000 in 3 months. See 50,000 Lufthansa Miles & More Bonus Returns. Miles & More miles are the best way to book Lufthansa first class in advance, which is especially valuable when you have specific dates to plan for or two or more people are traveling. SPG points transfer to Miles & More, so you can top up your miles that way. Miles & More miles can also be used for United BusinessFirst for 17,000 miles each way, no fuel surcharges (see Best Ways to Use Lufthansa Miles & More Award Chart).

- Barclays Arrival Card – 40,000 Bonus Miles = $440 Rebate on Travel: The best use of the Barclays Arrival card is to redeem the signup bonus, plus any other miles you earn from card spend (2x miles for ALL spend) for a rebate of your travel expenses. For example, you can get the airline fees and fuel surcharges rebated when you pay using the card. It's especially handy if you have foreign carrier fees, for example on a one way flight departing from an international destination, where the fees are in the local currency, since there are no foreign exchange fees on the card.

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 90,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book Your Hotel with Virtuoso or Four Seasons Preferred VIP Amenities!