Have you joined Kiva? If not, here's why you may want to:

- Make a small loan (from $25) that helps an individual or small business in the developing world

- 98.94% of Kiva loans are repayed

- 100% of your loan goes to the individual or small business (no administrative overhead)

- You get to choose the exact individual or small business you loan to

- Kiva's field partners disburse the loan, and you can view stats on their portfolio, delinquency rate, etc. when deciding whether to loan

- Earn miles or points, since you can use your credit card to make your loan

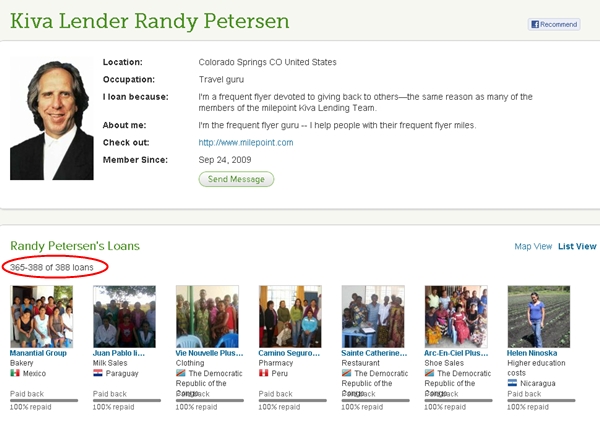

Plus, in addition to the smiles you'd bring to the small business owners you lend to, you'd help bring a smile to Randy Petersen, a longtime Kiva supporter. Over the years, he's made 388 Kiva loans:

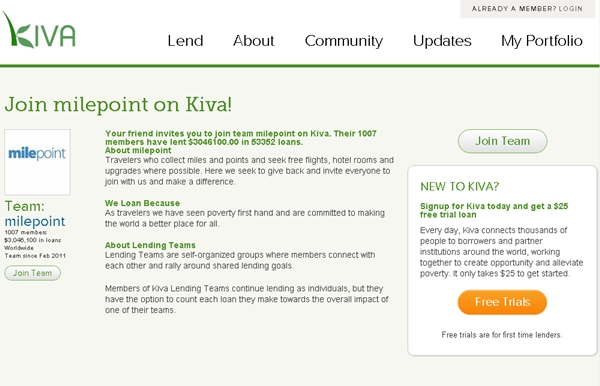

Randy's home has been terribly damaged by the worst ever hail storm to hit Colorado Springs, so yesterday a number of Boarding Area bloggers put together #SmileSaturday to encourage readers to join Kiva and the Milepoint Kiva Lending Team. The Team has made over $3 million Kiva loans, and thanks to a number of new signups yesterday, there are now over 1000 members!

But why stop there? If you're not yet a Kiva member, why not join? You'll even get a free $25 loan so you can try out the process. And if you're already a Milepoint Kiva member, why not make another loan, to support your chosen borrower and also Randy?

If you haven't joined, here's how:

1. Join the Kiva Milepoint Team

Click on this link to join: http://www.kiva.org/invitedto/milepoint/by/travelsort1084

While this is my invite link, there are no referral benefits to me; the only benefit is to you, as you'll receive a free $25 trial loan by using an invite link, as opposed to signing up directly on the Kiva site.

Here's what you should see:

2. Search Borrowers

You can use any key word to search for borrowers; I decided to do a search for Kyrgyzstan, as it's a meaningful place for me, having lived and worked there one summer. Here's Zarema, a young mother of two who both works as a nurse and raises livestock for additional income for her family:

3. Decide Your Loan Strategy and Make Your Free Loan

Kiva's average default rate is very low, but obviously there is always some risk of default. Look at the sidebar where it tells you the field partner's delinquency rate, loans at risk rate, and actual default rate. Keep in mind the delinquency may be either from the borrower or field partner, since it's from the perspective of Kiva. In my case, for Bai Tushum & Partners, Kiva's field partner in Kyrgyzstan, the default rate is 0%, delinquency rate is 0.13% and loans at risk rate is 0.41%. Good by me, especially as for now I'm just making a $25 loan to this particular borrower. I've only just started, but if you're thinking of making a ton of loans (for example to meet minimum spend for a credit card), here's what I'd suggest

- Diversify your risk by making many $25 loans to different borrowers, rather than a few large loans

- Lend to low risk field partners that have a low (preferably 0%) default rate and low delinquency rate

- Avoid field partners with very high portfolio yield: portfolio yield is the average interest rate and fees that borrowers pay to the field partner administering the loan. These total interest and fee rates will often be higher than you would ever accept a loan at, so you have to decide if you're comfortable with making a relatively high interest loan, recognizing that in many countries, there's only one field partner Kiva works with and the borrowers probably don't have any lower cost alternatives for getting this growth capital.

- Get repaid quickly: Seek out loans that will be repaid relatively quickly, so that you'll get your money back sooner and can either reinvest in additional loans or withdraw the funds

- Lend to women: I know this sounds sexist, but a number of studies have shown that women's repayment rates are superior to men's

- Avoid very large loans: Avoid very large loan amounts, since there tends to be more risk in the borrower paying them off. Also, precisely because many micriofinance field organizations prefer to lend to women for the reason above, a very large loan amount may be one that a husband or other male family member has pressed the woman to apply for. Smaller loan amounts tend to be ones that women remain in control over and are able to repay.

You can also use Kiva Lens to help you quickly filter loans according to your chosen parameters and the bulk add tool to add as many in your filtered results (those that met your criteria) up to the maximum you specify.

4. Maximize Miles and Points for Future Loans

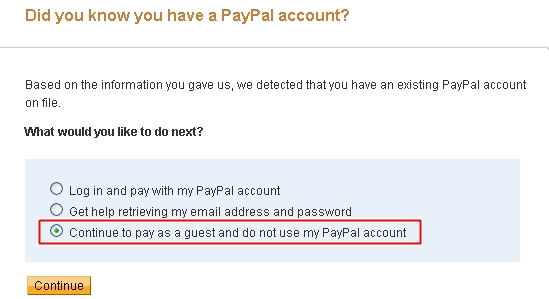

I used the Visa gift cards I got last month with the Ink Bold and Staples to get over 7x on my Kiva lending. Although PayPal processes the credit card transactions, you don't have to use your PayPal account (and I'd advise against it, if you too want to use a gift card to get 5x or more points). Simply choose to proceed as a guest, and don't log into your PayPal account:

5. Get Paid Back, Repeat, or Withdraw Funds

Check the “Repayment Schedule” tab to see the repayment schedule; if it says “irregular” it just means that it's neither once a month nor all at the due date; it could still be according to another schedule. In Zarema's case, she's expected to repay the loan in two installments in 2013.

When your loan is repaid (without interest), you'll receive Kiva credits that you can either loan out again or withdraw. You'll withdraw using PayPal (so you will need to have a PayPal account for this) to your bank account. If you're looking to maximize miles and points, you'll probably want to withdraw and use a credit card or gift card to make new loans, but do take into account that it costs Kiva money to process payments via PayPal, and donate something to them if you're doing this a lot. Note that donations to Kiva are tax deductible, but loans of course are not.

Related Posts and Resources

Mommy Points: I Need Your Help