I'd heard of Chase Exclusives, but it wasn't until I took a quick look at my Ultimate Rewards points for the Chase Freedom I got earlier this year that I began to realize just how great the bonuses can be for this “poor cousin” of the Chase Sapphire Preferred. First, let's take a look at what Chase Exclusives is:

Chase Exclusives Background

Chase Exclusives is JPMorgan Chase's effort to deepen its relationship with each customer to span different products. Banks have obviously tried to cross-sell their products for a long time, without a great deal of success. By rewarding Chase checking customers who also have certain Chase products, such as the Chase Freedom card, CD, mortgage, home equity line, auto loan or investment account, Chase Exclusives aims to retain these customers and (hopefully for Chase) sell more to these existing customers, rather than have to spend more marketing dollars acquiring new customers.

Good: Chase Freedom

Pros:

- No annual fee

- 10,000 points (or $100 cash back) after $500 spend on the Chase Freedom within the first 3 months

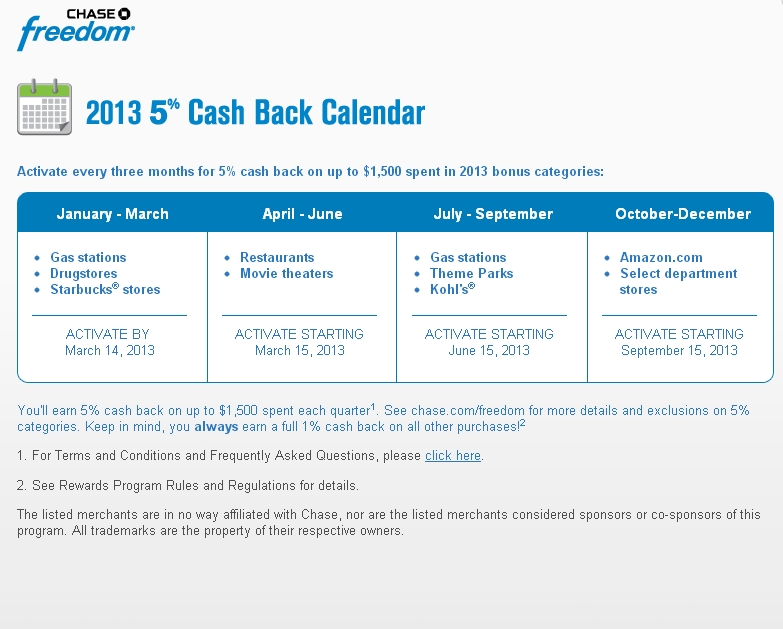

- 5x quarterly bonuses: 30,000 more points (or 5% cash back) for up to $1500 on quarterly bonus categories (Amazon.com and gas stations 1/1/12-3/31/12); see our Chase Freedom Visa Review for more info

Cons:

- Points may NOT be transferred to Ultimate Rewards unless you also have an Ultimate Rewards card, such as the Chase Sapphire Preferred or Ink Bold Business card

- Need to remember to activate the quarterly 5x bonus

Better: Chase Freedom + Chase Sapphire Preferred

Pros:

- The above plus:

- With the Chase Sapphire or Ink Bold, you can transfer Chase Freedom points to Ultimate Rewards airline and hotel partners: best value are transfers to United and Hyatt

- Chase Sapphire is in our view the top travel credit card:

- 50,000 Ultimate Rewards points after $3000 spend on the Chase Sapphire Preferred within the first 3 months (note that bonus has been reduced to 40,000 on the Chase site)

- Points may be transferred 1:1 to United/Continental, British Airways, Korean Air, Hyatt, Marriott, Intercontinental/Priority Club, Amtrak

- 2x points on all travel and dining spend

- No foreign transaction fees

- $95 annual fee waived the first year

Cons:

- $95 annual fee after the first year

Best: Chase Freedom + Chase Sapphire Preferred + Chase Exclusives

Pros:

- All of the above plus:

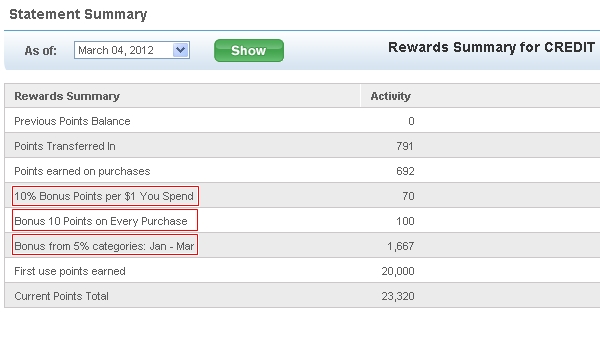

- 10% bonus on all base points earned with Chase Freedom spend. So spend $10 and you'll get 11 points (10 points for the $10 + 1 point as a 10% bonus)

- 10 bonus points per transaction: so even if you charge less than $1, you'll still get 10 bonus points for the transaction!

- Need to open a Chase checking account if you don't already have one, and may need to keep a minimum amount in it to avoid fees

- You'll need the Chase Sapphire Preferred in order to transfer out your Chase Freedom points to Ultimate Rewards partners

- The Chase Sapphire Preferred is the top all-around travel rewards card, and the 50,000 bonus is going away soon

- Although you can sign up for a checking account after getting the Chase Freedom, it could take some time to link them so that you get your Chase Exclusives bonuses. If you already have a Chase checking account open, the process is automatic.

- Make sure to try to find a bonus for opening a Chase checking account. People report incentives from $150-$250 to open a Chase checking account.

- Note that even if you live in a state with no Chase retail branches, you can still sign up for a Chase checking account *if* you are able to apply in person at a Chase branch in another state *and* have a local address you can use in that state when applying (perhaps a family member's?) Then, after 30 days, you can switch your address on file to your actual home address and continue to simply use online banking, reaping the benefits of the Chase Exclusives bonuses

- Although the current bonus of 10,000 points is less than past offers of 30,000 and 20,000 points, the 5x bonus categories and Chase Exclusives bonuses still make it a very worthwhile card

- Make sure to activate and max out the 5x quarterly bonuses, for a total of 30,000 points for bonus category spend

- Put small transactions, such as metered parking, vending machine spend, etc. on the Chase Freedom to take advantage of the Chase Exclusives 10 bonus points per transaction

Chase Freedom 2013 Categories and Calendar

Maximizing the Freedom Q1 2013 5X Bonus for Drugstores, Gas Stations and Starbucks

Check out and apply for the Best Travel Credit Cards.

If you enjoyed this, please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a Member to find your perfect luxury or boutique hotel at up to 50% off: TravelSort Hotels