The Chase Sapphire Preferred has eliminated the 7% annual points dividend, but added primary car rental insurance, including in the U.S.

To be honest, I haven't had the Sapphire Preferred in a couple years, and even my husband barely uses his card. That's because I find it more worthwhile to use our credit card spend to:

1. Earn signup bonuses for other cards, such as the Citi Executive AAddvantage (there used to be a 100K offer, now the best offer is the 75K Citi Executive AAdvantage), and the recent (but now dead) 60K Ink Bold and Ink Plus offer

2. Earn category bonuses, particularly 5X on all Amazon spend and 5X on all Whole Foods spend via gift cards bought at an office supply store using an Ink Bold or Ink Plus, or 5X on dining via restaurant gift certificates bought with the Chase Freedom 5X bonus during Q2 2014; or

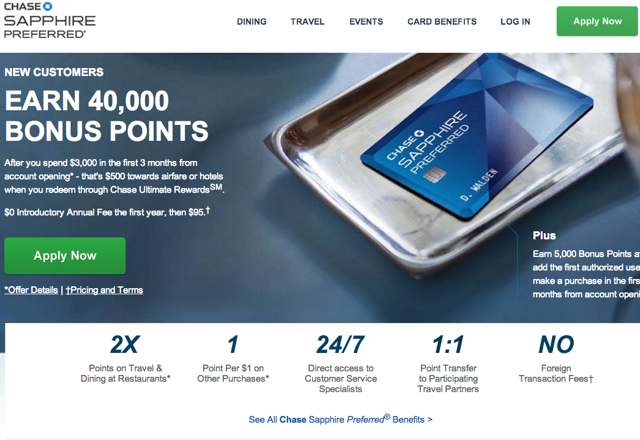

As a result, I honestly haven't missed not having a Sapphire Preferred card. That said, I know for some folks the 7% annual dividend has been an important feature–it provided 7% extra points on all awarded points, excluding the 40,000 points signup bonus (or 50K for Chase Private Clients–see 50K Chase Sapphire Preferred for Chase Private Clients) and 5000 points for adding an additional authorized user.

FAQ

Can I Still Apply for the Chase Sapphire Preferred Today and Get the Version with the 7% Annual Dividend?

No–the benefit has already been eliminated for new applicants effective today.

I Currently Have a Chase Sapphire Preferred–Am I Grandfathered for the 7% Annual Dividend?

Yes, through end of 2015; so your last 7% annual points dividend will be given in early 2016.

What Benefits is the Chase Sapphire Preferred Adding to Replace the Loss of the 7% Annual Dividend?

The new benefits are:

- Primary CDW insurance worldwide, including the U.S.

- Trip cancellation and trip interruption insurance increases from $5000 to $10,000 per trip

I Don't See These New Terms on the Chase Sapphire Preferred Application Page

They haven't been updated yet. If you're an existing cardmember, expect to receive an updated benefits leaflet via snail mail.

Why Should I Care About Primary Car Rental Insurance Coverage?

As Linda notes below, it's a big difference whether a credit card covers primary car rental CDW (collision damage waiver) insurance vs. secondary car rental CDW coverage. Most U.S. credit cards only offer secondary coverage, which is next to worthless if you have your own car and insurance coverage. That's because secondary coverage forces you to first file a damage claim with your own insurance company, and then, only if your own car insurance company denies the claim, will the secondary coverage kick in.

Most people of course would just buy CDW coverage at that point from the car rental company, so as not to risk their car insurance premiums going up over some scratches or dents to the rental car. With primary coverage, however, the credit card issuer, in this case Chase, will cover the damage to your rental car, so you'll never have to notify or file a claim with your regular car insurance provider.

I Don't Even Have a Car or U.S. Car Insurance–So How Does This Primary CDW insurance Benefit Me?

It doesn't, unless you don't have another credit card that offers CDW insurance in the country you'll be renting a car in. Living in NYC, I don't have a car or car insurance, so every credit card offering secondary car rental insurance becomes primary. The same is true for everyone else who doesn't have their own car rental insurance.

What do you think of these changes to the Chase Sapphire Preferred?

Related Posts

Credit Cards with Primary Car Rental Insurance Coverage

Best Ways to Use Chase Ultimate Rewards Points

Trip Delay and Trip Interruption Insurance: Which Credit Cards?

Need Award Booking Help? Our fee is as low as $75 per ticket if you book your hotel through us.

If you enjoyed this, join 100,000+ readers: please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a TravelSort Client and Book 5-Star Hotels with Virtuoso or Four Seasons Preferred Partner Amenities!

Disclaimer: Note that some cards in this post offer credit to me if you’re approved using my links. The opinions, analyses, and evaluations are mine. This content is not provided or commissioned by Chase, Barclays, American Express, Citibank, US Bank, Bank of America, or any other company. They have not reviewed, approved or endorsed any of my articles.