Update: Please see BankDirect Devaluation

BankDirect AAdvantage Mileage Checking

When we wrote about the Best American AAdvantage Miles Bonus Offers Available Now, we mostly focused on Citi AAdvantage credit cards, as well as a Fidelity Brokerage Account bonus.

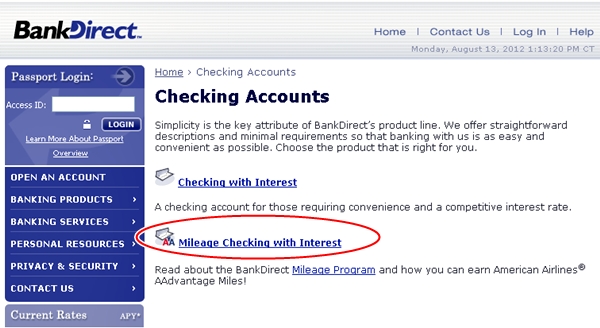

Today, I'll write about BankDirect AAdvantage Mileage Checking, which enables you to earn American AAdvantage miles with your checking account.

BankDirect is a small Texas-based bank (though it is FDIC insured), and so far as I know, it's the only one to have mileage products that enable you to earn miles on an ongoing basis (as opposed to offers such as Fidelity's which are a one-time signup bonus).

Here are the key benefits:

- Earn 100 AAdvantage miles per month for every $1000 in your checking account up to $200,000. You earn an additional 25 miles per $1000 in balances over $200,000.

- Mileage Checking Accounts that are over $2500 earn 0.01% interest

- Free Visa CheckCard for ATM withdrawals: BankDirect reimburses fees for up to 4 ATM withdrawals per statement cycle, up to $2.50 per transaction

Example 1: $20,000 BankDirect Deposit = 24,000 AAdvantage Miles

You'd earn 2000 AAdvantage miles per month (100*20), or 24,000 AAdvantage miles per year

Example 2: $200,000 BankDirect Deposit = 240,000 AAdvantage Miles

You'd earn 20,000 AAdvantage miles per month (100*200), or 240,000 AAdvantage miles per year

Are There Any Catches to Using BankDirect?

So what's the catch, you may ask? Well, there is a $12 per month fee, so $144 per year. So this isn't the best checking account if you don't have much money to deposit.

Other BankDirect Fees

- If you close your BankDirect Mileage Checking Account within 90 days of opening it, you're charged a $15 account closing fee

- For details on wire transfer fees, stop payment fees, etc. see BankDirect Fees

Signing Up Can Take Awhile

When my husband and I signed up, we initially got our form returned because we omitted to initial something on it, and then it took about a month for the account to be approved. Like I said, it's a small operation, so it can take them time to vet new accounts.

Don't Expect Miles to Post at the Same Time Every Month

Miles usually post around the 12th or so of the month, but the exact day seems to vary. Don't sweat it–where else are you going to get AAdvantage miles from a checking account, anyway?

BankDirect Can Terminate Your Accounts for Inactivity

BankDirect is obviously not offering mileage products because they want to help you fly first class in Cathay to Asia; they're using their mileage products as a marketing tool to try to gain additional customers. Note that they do reserve the right to terminate your account due to inactivity, and there's been at least one case reported on FlyerTalk where they did just that, after there was minimal activity for a year on a couple's two accounts, each with about $200,000 in them. So try to have some activity in your account, whether by automatic bill pay, some free ATM withdrawals, or transfers into the account.

But all the above notwithstanding, this is still a pretty unbeatable deal if you value American AAdvantage miles, which you can use to fly First Class on Cathay Pacific to Asia, as we'll be doing soon. We redeemed British Airways miles to fly Cathay First Class, but that was before the British Airways award chart devaluation. The best way to get these awards now is with American AAdvantage miles.

But wait, you say, what about the interest I'm losing out on if I open a BankDirect AAdvantage Mileage Checking Account that only pays 0.1% interest? Let's run the numbers.

BankDirect Checking: Buy AAdvantage Miles at Half a Cent/Mile for a 200,000 Deposit

Currently, most bank accounts are not paying more than about 0.85% interest, if that. Let's look at what you would earn in the above two examples.

Example 1: $20,000 Deposit in an Account Paying 0.85% APY, Marginal Tax Rate of 28%

Let's suppose that you put $20,000 in an account paying 0.85% interest; at the end of the year you'd have $170. But, unlike with the AAdvantage miles, you have to pay tax on that interest. If your marginal tax rate is 28%, you'd be left with $122.40. As we said above, if you'd put $20,000 into BankDirect, you'd have 24,000 AAdvantage miles at the end of the year, but you'd also have paid $144 in fees.

To figure out the opportunity cost of the BankDirect miles, we have to add the $144 in annual fees to the $122 in after-tax interest you would have otherwise had, then divide by the 24,000 AA miles. That works out to 1.1 cents per AA mile. Not bad, since most folks value an AA mile at 1.5-1.7 cents per mile (see Update: How Much is a Mile Worth?) but the real value of BankDirect is if you can put much more money into a checking account:

Example 2: $200,000 Deposit in an Account Paying 0.85% APY, Marginal Tax Rate of 35%

Let's suppose you can manage to put $200,000 in an account paying 0.85% in interest. I know it's a lot, but honestly how much are you making in the markets these days? Probably not much, unless you managed to short Facebook soon after its IPO. But I digress…

Anyway, at the end of the year you'd have $1700 in pre-tax interest. If you can afford to put $200,000 into an account, you're more likely to have a marginal tax rate of 35%, which would leave you with $1105 after tax.

This time, the opportunity cost is ($1105 + $144)/240,000 miles = 0.5 cents per AA mile. A much better deal!

Ok, so with apologies for involving math in a travel post, let's get into:

Other ways to earn additional miles with BankDirect

- 10,000 AAdvantage miles for payroll direct deposit (requires that you direct deposit your full payroll from all income sources to your BankDirect Mileage Checking Account for 3 consecutive months)

- 5000 AAdvantage miles for using bill pay for 12 months or more (must pay 3 different merchanges each month for 12 consecutive months through the BankDirect online bill payment system)

- 5000 AAdvantage miles for using Visa CheckCard (you must use the Visa CheckCard on 12 transactions per statement cycle for 3 consecutive months)

Important: Unfortunately, you must contact BankDirect Client Support after you have met the minimum qualifications for these bonuses and allow 6-8 weeks for them to post to your AAdvantage account; BankDirect does *not* track them and will not automatically apply them.

Another way to earn up to 10,000 AAdvantage miles is to Refer a Friend; you receive 1000 AAdvantage miles, and your friend receives 2000 miles (1000 miles for opening a new account, and 1000 extra miles for being referred by an existing BankDirect customer).

If you don't already have a BankDirect account, I'd recommend you sign up for FlyerTalk and request a referral from someone in this Flyertalk thread who hasn't already referred 10 people (the maximum you can refer with the referral bonus is 10). Assuming the person referring you hasn't yet referred 10 people, you will receive an extra 1000 AAdvantage miles and the person referring you will also receive 10,000 AAdvantage miles.

Between BankDirect and Citi AAdvantage credit card sign ups you should be all set with American AAdvantage miles; and for United miles, you can easily pick up 90,000 United miles with an application for the Sapphire Preferred (40,000 points) and the Ink Bold (50,000 points) or the Sapphire Preferred and the Ink Plus (50,000 points), since Ultimate Rewards points transfer 1:1 to United miles. Don't forget that even if you already have the Ink Bold, you can get another 50,000 points with the Ink Plus, as it's a different product. Having a nice stockpile of both AAdvantage miles and United miles gives you access to Oneworld and Star Alliance partner airlines, including our favorites: Cathay Pacific (Oneworld); Qantas (Oneworld); Singapore Airlines (Star Alliance); Lufthansa (Star Alliance) and SWISS (Star Alliance), plus many others.

Related Posts:

Check out and apply for the Best Travel Credit Cards.

If you enjoyed this, please follow TravelSort on Twitter or like us on Facebook to be alerted to new posts.

Become a Member to find your perfect luxury or boutique hotel at up to 50% off: TravelSort Hotels

Disclosure: I do have a BankDirect Mileage Checking Account, but I have no other connection to BankDirect and have not been compensated to write this post.